By: Gonen Hollander

- Venture capital investments are illiquid and require a longer holding period.

- Increase in valuation is only realized when there is an exit or a follow-on round (12-18 months is the average cycle).

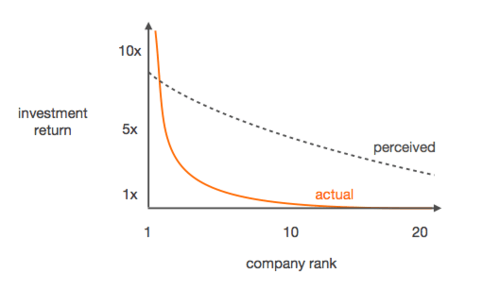

- Diversification is key – 20% of the companies will generate more than 80% of the returns

Venture capital is a good way to diversify a portfolio: it can provide a hedge against market downturns and has higher potential returns than the public markets. Nonetheless, there are things investors should keep in mind before making an allocation to this asset class. In this article, I mention a few of the things that investors ought to consider prior to investing in VC.

Illiquid and long-term

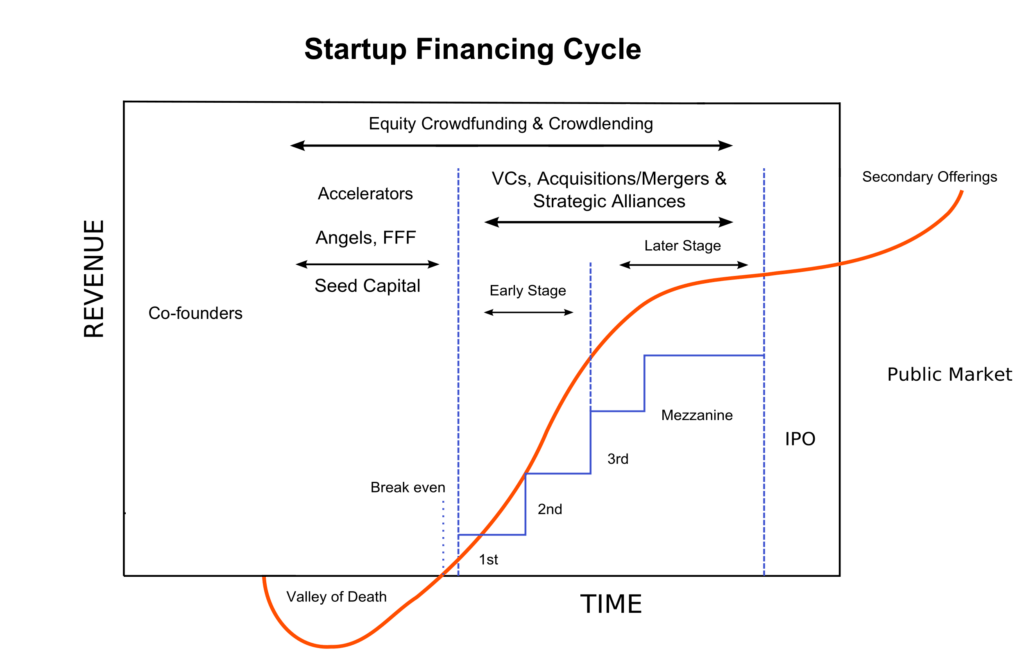

Pre-IPO investments by their nature are long-term investments. Hold periods range from 1-2 years for pre-IPO companies, 5-7 years for early growth, and up to 10 years for a traditional VC fund. While liquidity events can happen sooner, you should plan for a lengthy holding period and invest money that you will not need in the near future.

Changes in valuation

Unlike public equities, private investments do not have an ongoing market-driven price. Most venture capital firms use the following valuation methodology:

- An increase in value usually happens when the company is either exiting (IPO or M&A) or when there is a new investment round at a higher price per share (up round) with an external investor (investing for the first time). Otherwise, even if a company is doing incredibly well, growing revenues 3X YoY, and is profitable, it will still be held at cost.

- A decrease in value may happen when there is a new financing round at a lower price per share (down round) or if a company is underperforming.

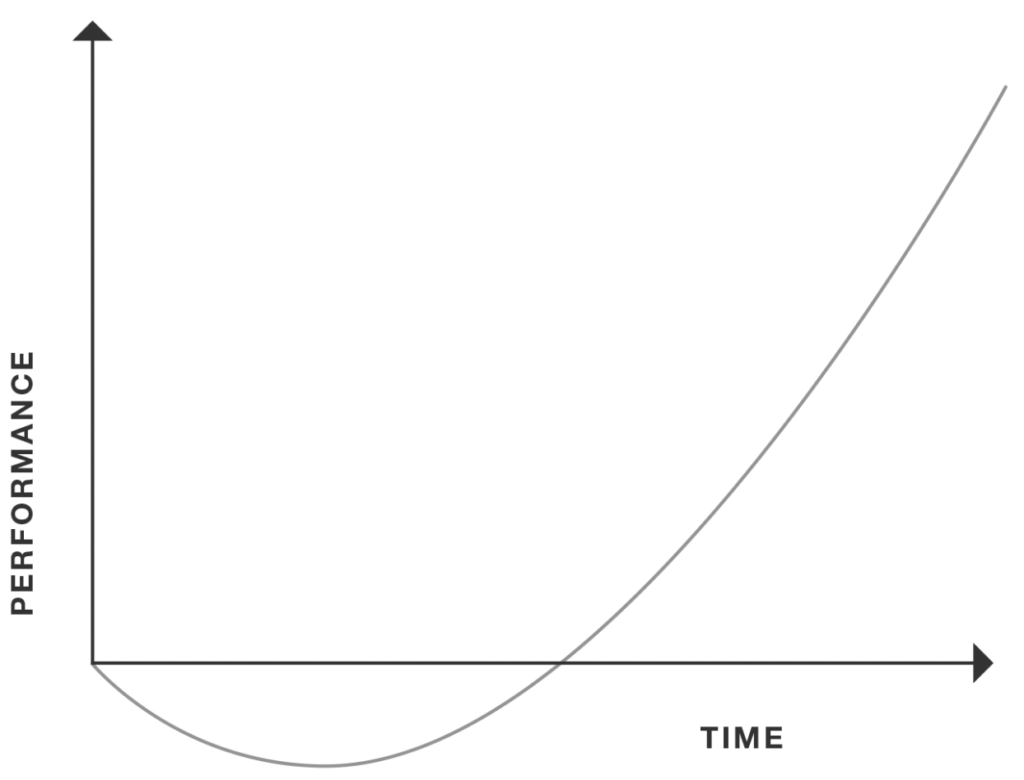

If you buy pre-IPO it will take time until the value of an investment will go up. On average, start-up companies take between 12-18 months before they raise their next round, which is typically when an increase in value is reflected. Management fees continue to accrue even before an increase in value may be on the books. As a result, venture capital returns tend to follow a “J Curve.”

There will be write-offs

One thing that we can guarantee in venture capital investing is that some of the companies will not succeed. Venture capital investing follows the power-law curve, which means that 80% of the returns will come from 20% of the investments. If an investor is making an investment in just one or two companies, they are statistically more likely to lose their investment than to come out ahead. Experts in the field recommend investing in a diversified portfolio of at least 12-15 companies to achieve the targeted returns (15-20% IRR).

Conclusion

For patient investors venture capital can offer superior returns and can be a great way to diversify a portfolio. At the same time, investors need to remember that venture investing is long term, illiquid, and valuation changes only happen over time.

If you want to learn more about the ways you can invest in venture capital with OurCrowd, reach out to me at gonen.hollander@ourcrowd.com or book a meeting directly using this link: https://meetings.salesloft.com/ourcrowd/gonenhollander . You can see current investment opportunities here.

OurCrowd operates in Canada through OurCrowd Canada Inc., an exempt market dealer registered in the Provinces of Ontario, British Colombia, Alberta, Manitoba, Quebec and Nova Scotia. Nothing contained in and accompanying this communication shall be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security by OurCrowd, its portfolio companies or any third party. Under no circumstances should this website be considered as a prospectus, a registration statement, a public offering or an offering memorandum as defined under U.S. or Canadian Securities Laws. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. Information regarding OurCrowd’s limited partnerships and/or portfolio companies and the investment opportunities on OurCrowd’s website is intended and available for accredited investors only (criteria at our website). OurCrowd urges potential investors to consult with licensed legal professionals and investment advisors for any legal, tax, insurance, or investment advice.