By: Gonen Hollander

Many individual investors and financial advisors may not have considered including venture capital as part of their portfolio because historically the minimum investment was in the millions of dollars.

Relatively new funding platforms such as OurCrowd offer qualified individual investors an opportunity to invest in start-up deals with modest investments at the same terms VC funds receive.

1. Higher historical returns

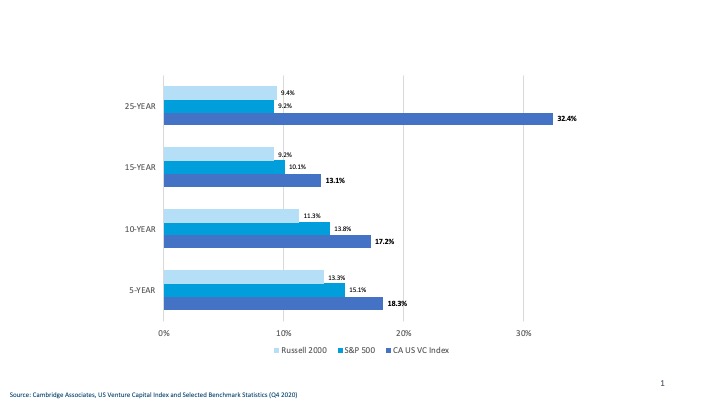

The most compelling reason to allocate a portion of your portfolio to venture capital is to improve your ROI: venture capital has historically outperformed the public markets. Compared with the S&P 500 and Russell 2000, Cambridge Associates US Venture Capital Index has consistently outperformed the two public market indices over any selected time horizon over the past 25 years

2. Follow the smart money

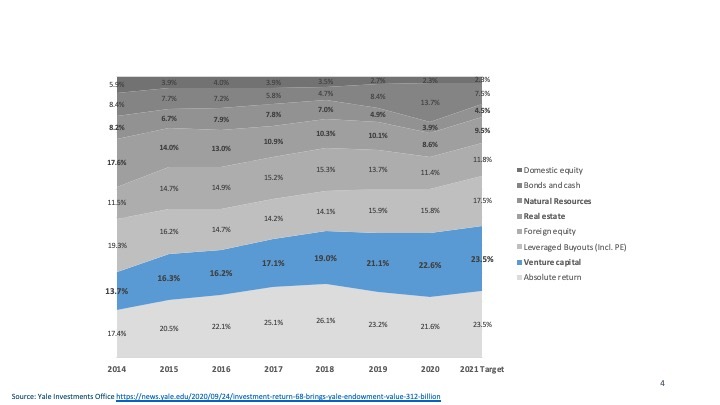

The smartest money in the investing world includes venture capital in their asset allocation. Institutional investors such as pension funds and endowments are increasing their exposure to alternative asset classes in general and venture capital in particular. The Yale Endowment Fund, which is considered by many to be the gold standard for asset allocation, has increased its venture capital allocation from 13.7% to a target of 23.5% for 2021 – almost a 10% increase in just 7 years!

3. Less upside potential for public market investors

- Companies are staying private longer

- Exit mostly through M&A (~95% of exits since 2000)

- If they do end up going public, they trade at a premium

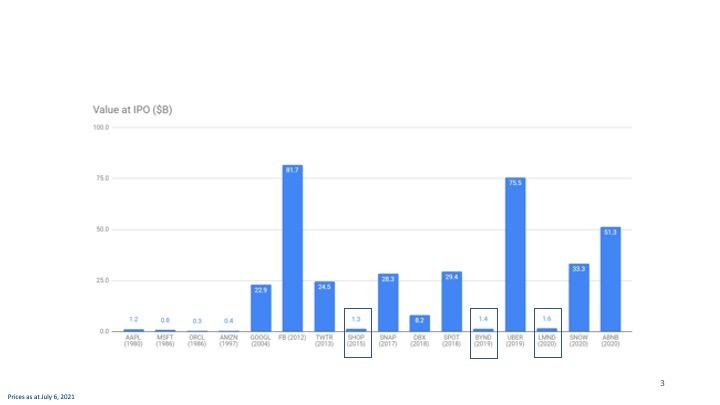

The amount of funding available for venture capital has increased dramatically over the last few years. As a result, many start-up companies are doing large, late-stage venture rounds that allow them to defer going public. These days, *IF* a company ends up going public, it is done at a much higher market cap with limited room for upside. The below graph shows how dramatically valuations at IPO have increased in the last 20 years. In the 80s and 90s, companies such as Amazon, Microsoft, and Apple went public at sub $1B (or slightly above), whereas post-2000, companies such as Uber, Snap, and Airbnb went public with market caps of tens of billions of dollars.

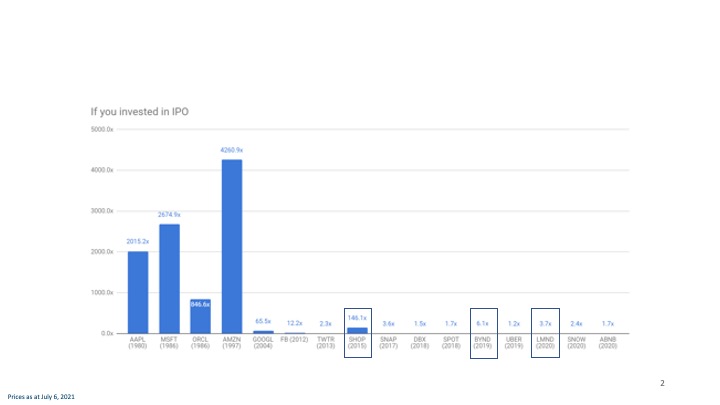

The following graph shows the returns in multiples for investments made at the IPO and held until now. It clearly shows that most of the value creation that used to occur on the public market now occurs privately. Pre-IPO investing is now the only way to make outsized returns.

4. Venture Capital is a great way to diversify your portfolio

Venture capital is not subject to the same volatility as the public markets. It also provides access to invest in some of the most exciting new technologies, such as quantum computing, cybersecurity, fintech, e-commerce, foodtech, and more, that have little to no representation on the public stock exchanges.

Conclusion

OurCrowd provides individual investors with an opportunity to buy pre-IPO. You can see current investment opportunities here.

If you want to learn more about the ways you can add venture capital to your portfolio with OurCrowd, reach out to me at gonen.hollander@ourcrowd.com or book a meeting directly using this link: https://meetings.salesloft.com/ourcrowd/gonenhollander

OurCrowd operates in Canada through OurCrowd Canada Inc., an exempt market dealer registered in the Provinces of Ontario, British Colombia, Alberta, Manitoba, Quebec and Nova Scotia. Nothing contained in and accompanying this communication shall be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security by OurCrowd, its portfolio companies or any third party. Under no circumstances should this website be considered as a prospectus, a registration statement, a public offering or an offering memorandum as defined under U.S. or Canadian Securities Laws. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. Information regarding OurCrowd’s limited partnerships and/or portfolio companies and the investment opportunities on OurCrowd’s website is intended and available for accredited investors only (criteria at our website). OurCrowd urges potential investors to consult with licensed legal professionals and investment advisors for any legal, tax, insurance, or investment advice.