By: Gonen Hollander

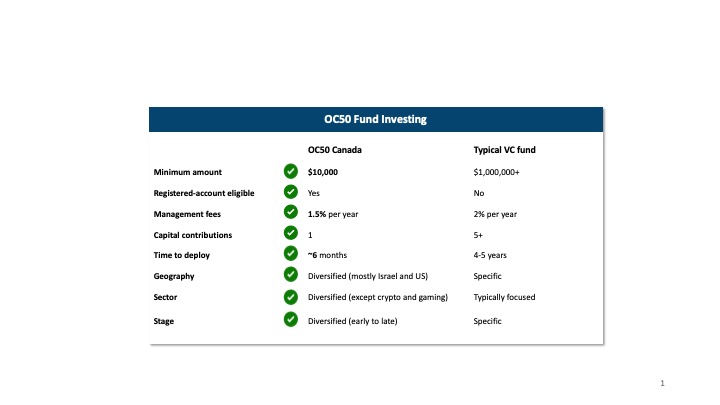

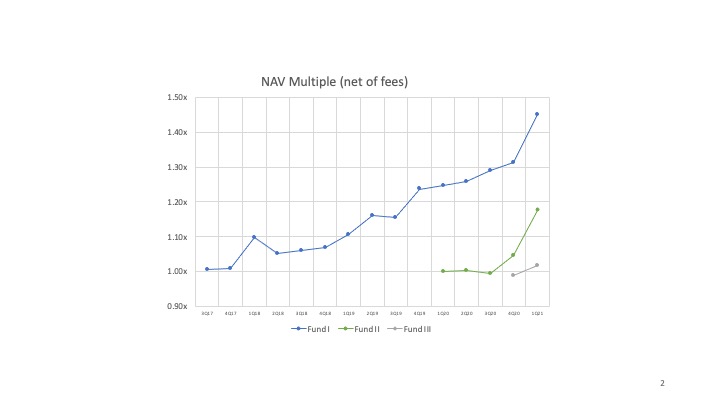

- OC50 provides a highly diversified portfolio across sectors, stages, and geography.

- OC50 is fully invested in approximately 6 months (in comparison to 4-5 years for the average VC fund).

- OC50 minimum is $10,000 per client and is registered-account eligible when investing through a registered broker.

OurCrowd has been Israel’s most active VC firm since 2018. It is also one of the largest venture capital equity crowdfunding platforms in the world. The OurCrowd 50 (“OC50”) Index Fund series was launched in 2017 to provide a way to passively invest in a highly diversified portfolio of startup companies.

OC50 is OurCrowd’s flagship product. Each OC50 fund invests in the next 50 companies in which OurCrowd invests. We are currently raising the fifth OC50 fund. In this article, I will highlight what makes OC50 stand out in comparison to other VC funds.

Portfolio diversification

Venture capital funds are typically focused on certain stages (Early/Growth/Late) and particular industries and geography. To diversify in sectors, geography, and stages an investor would need to invest in multiple VC funds. The typical minimums for reputable funds are greater than $1M and can be as high as $10M. This makes investing in a single venture capital fund, let alone diversifying in multiple venture capital funds, unaffordable for most individuals/money managers.

OurCrowd is a sector and stage agnostic investment platform. We invest in every stage (from seed all the way to pre-IPO), in almost every sector (except crypto and gaming), and across multiple geographies (mainly Israel and the US). OurCrowd’s model and scale means that investors in OC50 get a highly diversified portfolio of startup companies they can buy pre-IPO all in one place.

Pace of investment

When you read about a new $100M venture capital fund being raised, that means “capital committed.” On average it will take 4-5 years for the fund to be fully deployed. An investor in such a fund must have that capital readily available for 4-5 years, for capital calls that could happen at any time.

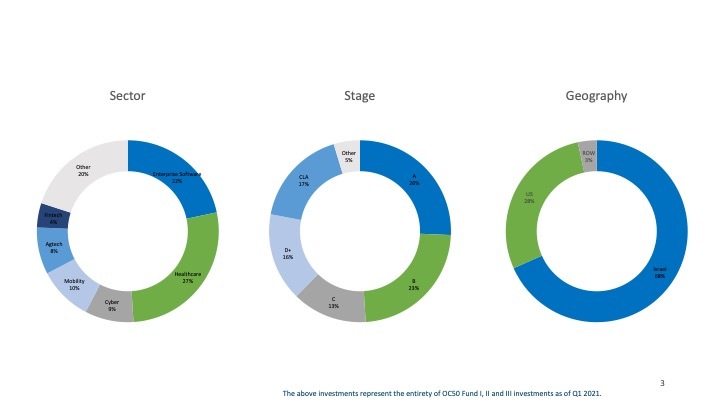

The pace at which OurCrowd is investing in new deals means that each OC50 fund is fully deployed in about 6 months. This reduces the nuisance by managing capital calls with one wire. It also ensures that your capital goes to work from day 1. Traditional venture capital firms often have a “J curve” in returns, where early returns are negative due to the expense of management fees hitting before funds are fully deployed and before there are valuation events. OC50’s pace of investments and portfolio diversification has led to the elimination of the “J curve” in funds I-III, see below chart.

NAV Multiple (net of fees)

Lower minimums and registered-account eligibility

As mentioned above, the typical entry point for venture capital funds is between $1M and $10M, which is unaffordable to most Canadians, including high-net-worth individuals and family offices. OC50 is offered to Canadian investors through a registered broker with a minimum only $10,000 per client, which could come from multiple accounts including registered accounts such as RRSP and TFSA.

OC50 provides typical investors an opportunity to participate in diversified pre-IPO investing. If you would like to learn how to add venture capital to your portfolio with OurCrowd, please reach out to me at gonen.hollander@ourcrowd.com or book a meeting directly using this link: https://meetings.salesloft.com/ourcrowd/gonenhollander . You can see current investment opportunities here.

OurCrowd operates in Canada through OurCrowd Canada Inc., an exempt market dealer registered in the Provinces of Ontario, British Colombia, Alberta, Manitoba, Quebec and Nova Scotia. Nothing contained in and accompanying this communication shall be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security by OurCrowd, its portfolio companies or any third party. Information regarding OurCrowd’s limited partnerships and/or portfolio companies and the investment opportunities on OurCrowd’s website is intended and available for accredited investors only (criteria at our website). OurCrowd urges potential investors to consult with licensed legal professionals and investment advisors for any legal, tax,