Crowdfunding is booming. The industry has come a long way since the first crowdfunding projects surfaced a few years ago. Going forward, crowdfunding is likely to take on many forms, expand globally and become the preferred model for investment.

Given the recent surge in its activity and popularity, here is a quick beginner’s guide discussing the origins and different types of crowdfunding platforms available for investment today.

What Is Crowdfunding?

Crowdfunding is the pooling of resources to create or maintain an initiative from a large number of backers—the “crowd.” Projects supported through crowdfunding, usually online by means of a web platform, can range from nonprofit or charity organizations, political campaigns, creative projects (i.e.- supporting an artist, gallery, director, film etc.) or a financing campaign to fund a startup company.

The Oxford dictionary definition for crowdfunding reads:

[Noun] The practice of funding a project or venture by raising many small amounts of money from a large number of people, typically via the Internet.

History of Crowdfunding

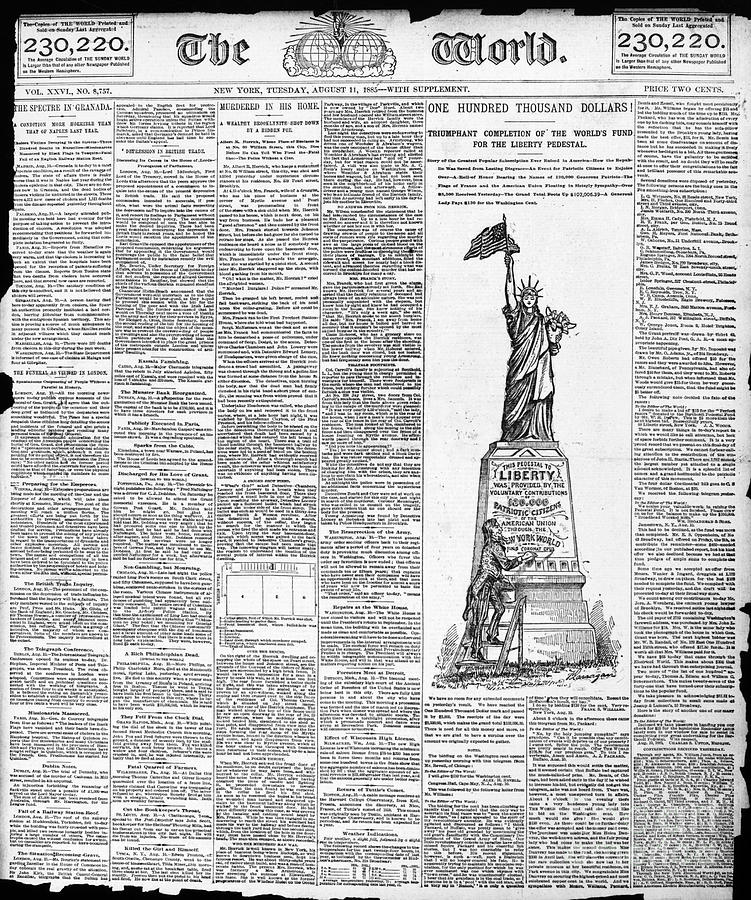

Crowdfunding has a long and rich history with roots going back hundreds of years. Crowdfunding originates in the concept of crowdsourcing, an individual reaching a goal leveraging small contributions from many parties. Crowdfunding is the application of this concept to the collection of funds.

Fast forward to the 2oth century, the first recorded successful instance of modern day crowdfunding occurred in 1997, when a British rock band funded their reunion tour through online donations from fans. However, it is only in this past decade that crowdfunding emerged as a popular option for entrepreneurs to raise money for their ventures. In April of 2012, President Obama signed the JOBS Act into law, also known as “the crowdfunding bill,” and legalized equity crowdfunding (though we’re still waiting for the SEC to define its rules).

All of these developments have shaped modern day crowdfunding and contributed to the recent surge in crowdfunding activity.

Different Crowdfunding Models

Crowdfunding models involve a variety of participants. Common models of crowdfunding include:

- Donation-based Crowdfunding, in which the backers essentially donates money to support a cause, for example raising money for a ‘race for a cause’ or other collective charity pooling. Kiva Microfunds, a platform that uses the Internet to fund low-income / under-served entrepreneurs, is a well-known example of this model.

- Reward-based Crowdfunding, in which the backer receives a reward with a clear monetary value in exchange of the pledge. The reward is often a product or a pre-series item that the backer helped produce by pledging money. In this case the money pledged is similar to paying for a pre-order of a product or service. Successful examples of this model are crowdfunding platforms Kickstarter and Indiegogo, which help to fund creative projects.

- Credit-based Crowdfunding, in which the backer lends the money and receives an interest rate in exchange. In this case the money is pledged in the form of a credit loan. Lending Club and Prosper are examples of these peer-to-peer platforms.

- Equity-based Crowdfunding, in which the backer, or in this case investor, receives shares of a company in exchange of the money committed. Investors in this model give money to a business and receive ownership of a small piece of that business. Harvard economist Michael Porter talks about the theory of economic development called “clustering.” In short, the growth of a local ecosystem is enhanced and accelerated the more dense and interconnected its network of diverse participants become. The place where entrepreneurs and investors are connecting to fund and grow businesses — equity crowdfunding platforms — will also be the places where more clustering happens rapidly online. AngelList and OurCrowd, are two examples of this equity-based platform model.

The Future of Crowdfunding

The crowdfunding market has grown tremendously since its inception. 2013 alone raised nearly $5.1 billion across all of the different crowdfunding platforms according to Massolution. The market is projected to grow an additional 100% in 2014, reaching a total market value of nearly $10 billion.

Young companies all across the globe are now taking advantage of this new-found accessibility to early stage capital to assist them in growing into profitable, scale-able companies.

Crowdfunding Investment Opportunities

OurCrowd is a leading global crowdfunding platform that provides top tier deal flow to its network of accredited investors. Individuals can now access promising startups that were once only available to large institutional investors. Within a year of its launch, OurCrowd has invested over $35 million in its 35 portfolio companies, from investors over 26 countries.

[xyz-ihs snippet=”CrowdfundingPlaybookCTA”]

![OurCrowd raises $72M & the Israel NY tech scene [OurCrowd Newsletter]](https://blog.ourcrowd.com/wp-content/uploads/2016/09/OurCrowd-Newsletter-banner.png)