Below is an excerpt from OurCrowd’s Q1 Innovation Insider, which you can download here.

Life without banking and credit cards in 2019 can feel like a real stretch of the imagination, but for many across the globe — from the developing world to the United States — it is very real.

No credit score means no financial history. No financial history means no lease. No lease means no mortgage, ever. No credit card means no e-commerce. No bank account means high fees for every cash checked. The obstacles go on and on. As the saying goes, it is expensive to be poor.

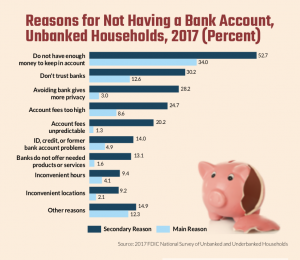

The underbanked, on the other hand, are more likely to live in developed nations like the US. According to a 2017 FDIC study, while only 6.5% of US households were unbanked, over 18% — or over 48 million adults — were considered underbanked. Though the underbanked may not have bank accounts, many do choose to use financial products, including payday loans and prepaid cards. However, many of these services charge high fees. Payday loans are considered among the worst abusers of predatory lending, with the average interest rate coming in at 391%. Similarly, Green Dot, a prepaid debit card sold at Walmart and CVS, charges nearly $8 if a user doesn’t load $1,000 a month onto the card. If someone is using a prepaid card at Walmart, chances are they are doing so because they do not have enough to open a bank account.

Enter FinTech startups.

Much attention has been given in recent months to new challenger banks like N26 and Revolut entering the US market. With hundreds of millions of dollars in funding and valuations in the billions, many are excited to see how these “digital only” banks will change the US banking ecosystem. But although these are digital startups, they’re still traditional banks. So the millions of un- and underbanked in the US will face the same problems they dealt with the day before these digital banks launched. But two such companies solving the underbanked problem are Rewire and TAPPP.

Rewire is born

Rewire started as a remittance company that provided migrants with low-cost services to send money back to their families. Remittances are a huge source of income for many across the globe. In a 2011 speech to the G20, Bill Gates spoke about the importance of lowering fees on remittances: “We must continue lowering the transaction costs of remittances, so that this growing pool of money has as big an impact as possible on the poorest. Reducing these costs to an average of 5% (compared to the current average, which is roughly twice that) would save $15 billion.” The worldwide average is still above 7%, with banks charging 10.99% on remittances.

Rewire soon began to notice that a large number of its customers wanted to leave money in their Rewire accounts from month to month for one simple reason: They did not have access to a bank account. Many of these migrants — living in the EU, US, or UK — could not open bank accounts for myriad reasons, including lack of identification and/or funds, no credit history and no permanent address.

Thus, Rewire evolved into a digital banking solution that provides underbanked internationals with digital wallet and debit card services to complement their low cost remittance product. And the incumbents are starting to take notice. The company has secured investments with strategic investors including Standard Bank South Africa, the largest bank in Africa.

Empowering the customers

But more importantly, Rewire is making a difference in the lives of the underbanked.

“We’re providing advanced financial services for underbanked people which is a key factor in their financial growth and in materializing their potential,” said Rewire CEO Guy Kashtan. “Access to advanced services through technology empowers our customers to significantly save time and money to be able to focus on what is important. Rewire customers, and migrants in general, are often the providers for their families back in their home countries and contribute immensely to the financial growth of their loved ones and countries.”

Supporting Rewire’s impact on the world, the company won a 2018 RemTech award for Remittances for Social Impact. Furthermore, one in three customers are referred by a friend, creating a viral effect in clustered migrant populations that are very protective of their hard-earned wages.

Another company dealing with the underbanked is TAPPP, the first investment from ADvantage, OurCrowd’s SportsTech fund. TAPPP is a pre-paid platform that provides access to premium live sports content to any consumer device. When signing up for subscription-based online sports content, users are required to provide a credit card for recurring or one-time payments. But for the millions un- or underbanked in the US, the requirement is a road block. In this case, the underbanked include millennials. TAPPP found that 49.7% of millennials are card-less, mostly by choice, providing the company with an underserved market ready to receive TAPPP’s service.

“Ultimately, what we are trying to do at TAPPP is give fans access and control over their sports viewing experience,” remarked TAPPP CEO Sandy Agarwal. “A prepaid sports streaming concept is unique and allows fans to decide when and how they want to pay for the service. Furthermore, a large portion of the US population does not have credit cards and therefore cannot avail these services. With TAPPP, now they can finally take advantage of these great services.”

TAPPP issues prepaid cards that are currently available at major retailers like Walmart, GameStop, and Dollar General for major US Sports Leagues like MLB and NFL. Unlike many other prepaid cards, there are no additional fees, which gives the customer fair market value for the services purchased at retail. While there are still billions of un-and underbanked adults in the world, the numbers have been shrinking. And they have been shrinking because of digital focused FinTech startups.

Still, there is much to be done before the world has financial inclusion. The un- and underbanked is a market that must not be ignored. It is an arena in which startups can really make an impact. Furthermore, the market is large, which means that investors can expect a return on their investment while affecting positive change in the lives of underserved people across the globe.

Download OurCrowd’s full Q1 Innovation Insider here.

About the Author

Josh Liggett is an investment analyst and fintech lead at OurCrowd. He also serves as a mentor at the Barclays/Techstars accelerator in Tel Aviv and advisor for BlockChain Israel.