Should startup investors bet heavily on one sexy startup? Or, should you keep your investments in startups relatively small and spread them out over multiple early stage companies?

This question of how many startups an investor should invest in is one of the most frequently asked questions in the startup investing world. For people who invest in venture capital funds, it’s not really a question they need to address. They assign a representative — a venture capital fund — to make investment decisions on their behalf.

But with the rise in popularity of angel investing and crowdfunding, investors are becoming more active in the startup investment process. The issue of the right number of startup investments an investor should make becomes a more integral part of the investment process.

2 approaches to investing in startups

- Concentrated, large bets: This approach is all about zeroing in a single or small number of investments with a relatively large bet on their success. It’s like a sniper who is down to just a couple of bullets in his investment gun. When he pulls the trigger, it’s gotta count. Investors who take this approach believe that they’ve identified a large, winning idea and will massively profit if their startup investment makes it big.

- Diversified portfolio: This is a more defensive approach to startup investing. Instead of betting on just 1 or 2 startups, this approach admits that it’s hard to identify winning investments. Good ideas don’t always make for good investments, so instead of concentrating investment money, these types of startup investors invest in multiple (say, 6-9) investments. The idea is to make smaller bets and spread the risk around enough in the expectation that some of the investments will fail.

Like investing in the stock market, successful investing in startups is about risk management. Most of the members of the Investing Hall of Fame (doesn’t really exist, but it should) like Warren Buffett didn’t make their billions by making super-concentrated bets. They did so by making sure they didn’t lose money along the way. They were portfolio managers.

By the way, the same risk management approach is used by successful entrepreneurs. Just read Peter Sims’ Little Bets: How Breakthrough Ideas Emerge from Small Discoveries. According to the research Peter did, top innovators and entrepreneurs got to the Promised Lands of Startup Success by not risking too much on their ideas, taking small bets and iterating along the way until they found their product or market.

Diversification and startup investing

Successful investing isn’t about nullifying risk — that’s impossible. When you’re making a bet on a future outcome, there’s risk involved. History’s best investors have found the right mix of risk for a given expected future return.

The allure of riches sometimes clouds people’s thinking. Early on, when an investor begins looking seriously at making startup investments, it seems like almost every startup you meet is on the verge of becoming the next Google, the next Facebook. With time, though, and the experience of informally benchmarking every new startup you see against what you’ve seen previously, it gets easier to see that some startups are better positioned for success than others. Maybe their teams are stronger, experience greater, idea more baked, or aiming at a larger, bigger market.

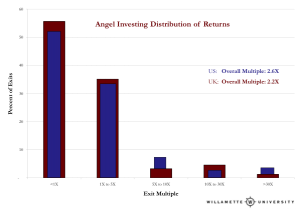

Startup investing returns improve greatly when you begin to build a portfolio. According to Robert Wiltbank at Willamette University, while most angel investors lose money, when angel investor begin building portfolios of at least 6 startups, their returns go from negative to positive — in fact, the average startup investor with at least 6 startups in his or her portfolio, sees returns upwards of 2.5X on his/her money.

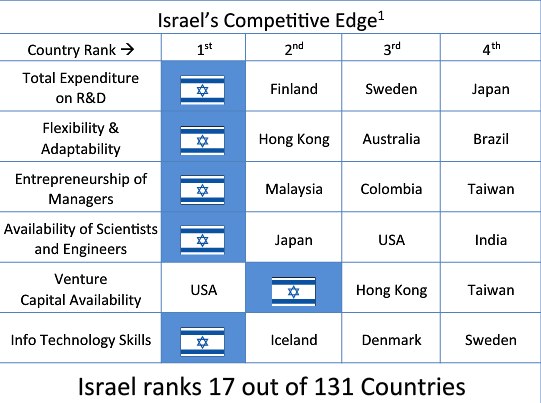

OurCrowd and the diversification benefits of investing in Israeli startups

OurCrowd employs a hybrid model that takes the best of angel investing (discretion, smaller minimums) with the professionalism of venture capital (we screen all our deals and invest our own capital alongside individual investors). Successful investing in Israeli startups requires a portfolio approach — Israeli M&A encompasses a smaller number of deals (there were about 50 Israeli exits in 2012) and a relatively small exit size (an average of $111M per deal).

Our platform is an easy way for investors in startups to build a portfolio of Israeli startups. With as little as $10k per deal, investors get a vetted, steady flow of startups in the medical, telecommunications, security, e-commerce, etc. fields.

If you’re an accredited investor, apply to OurCrowd and begin building your own startup portfolio.