What is a SPAC and Why Should I Care?

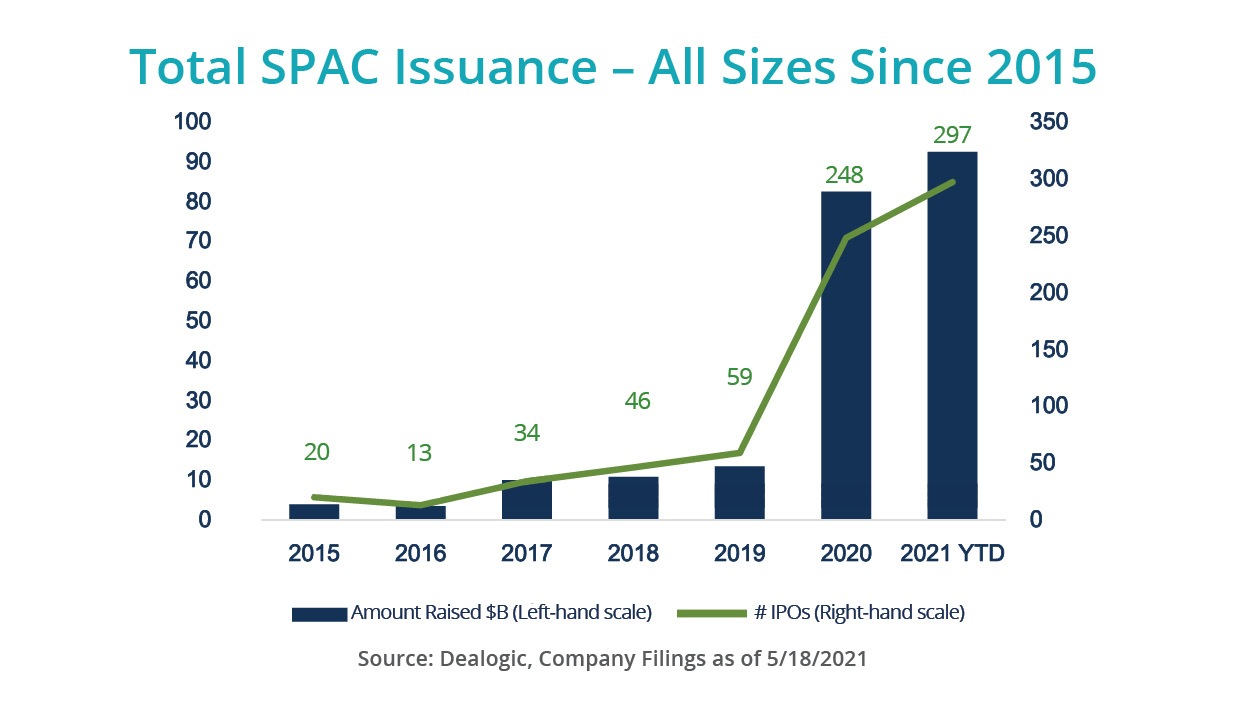

Over the past year special purpose acquisition companies (SPACs) have become the hottest commodity in the initial public offering (IPO) market. A few years ago, SPACs were rare and were considered by many to be somewhat disreputable: it was felt that only a company that wasn’t strong enough to go the traditional IPO route would go public via a SPAC. That changed dramatically last year. In 2020, SPACs raised half as much money as traditional IPOs, and, as reported by Reuters, for the first quarter of 2021 they’ve raised 76% as much money as traditional IPOs. Clearly SPACs are a hot ticket in the world of finance right now.

Two of OurCrowd’s portfolio companies – Arbe Robotics and Innoviz Technologies – have exited via SPAC, and we expect more to follow.

However, the recent boom in SPAC offerings is drawing additional scrutiny from regulators, which may put a damper on the current frenzy. The US Securities and Exchange Commission (SEC) is concerned because a number of companies that went public via SPAC have seen their shares drop significantly in value post-acquisition, indicating possible problems in how those acquisitions are valued.

In this post we look at what SPACs are, how they work, and the impact of SPAC-mania on small investors.

SPAC Basics

SPACs have often been called “blank check companies,” because in essence investors in SPACs are giving the SPAC sponsors a blank check to go out and acquire one or more unspecified companies.

The people who form a SPAC are called sponsors. They must put up some of their own money to cover the formation and registration expenses of the SPAC. Sponsors are typically people with experience and business reputations that are appropriate to the process of finding a business to acquire and bringing it through the process of becoming a public company. Recently, some celebrities have joined the ranks of SPAC sponsors, bringing their fans as new investors to the market.

A SPAC goes through the full IPO registration process with the SEC. Since the SPAC is not an operating company, disclosures, due diligence, and other formal reviews are significantly more simple than would be demanded of a fully-functioning company. On completion of the IPO process the SPAC is a publicly-listed and traded company.

SPACs typically are priced at $10 per share and are usually packaged in a unit with a warrant for a share or fraction of a share that is always priced “out of the money” – usually at a price of $11.50. The warrant provides the initial investors with compensation for leaving their money sitting in the SPAC trust account until an acquisition is completed.

The money raised by the SPAC at its IPO is held in an interest-bearing trust account until the SPAC completes an acquisition.

When the SPAC finds a company to merge with, investors are given the choice of maintaining their investment in the combined public company or getting back their $10 plus interest.

If the SPAC fails to complete an acquisition within a specified timeframe (typically 18-24 months) the investors get their money back with interest.

Implications of Exit via SPAC for OurCrowd Investors

From the perspective of the operating company merging with a SPAC (and therefore for the investors in that company) a SPAC has several advantages over other exit strategies.

- Compared to a traditional IPO, the process is much faster, cheaper, and simpler. Even though at the end of the process the company will be publicly traded and will have to comply with SEC rules, the process of getting there involve much less paperwork, disclosures, filings, road shows, attorney and investment banker fees, and other expense and bureaucracy associated with a regular IPO.

- Merging with a SPAC is much less risky than a traditional IPO. The valuation is fixed by negotiation, so is not as dependent on market conditions at the time of the transaction. Many companies have spent hundreds of thousands of dollars preparing for an IPO, only to be forced to shelve it because market conditions turned unfavorable.

- Compared to an acquisition by another operating company, the company maintains its independence and has access to public capital markets. There may be more upside in valuation.

- Companies are able to provide more detailed business plans and long-term forecasts which under the regular route of an IPO cannot be used. This leads to different pricing dynamics which in some cases favor the operating company, as SPACs are valued according to future financial estimates and projected earnings, and also given credit for them.

- Private Investment in Public Equity (PIPE) is an important element in a SPAC’s success, providing investors with a sanity check. PIPE investors are most frequently institutional investors who evaluate and invest in the combined SPAC and operating company upon its de-SPACing. Before investing, PIPE investors conduct full due diligence on the opportunity and give their opinion on the valuation of the joint entity and its potential to increase in value as a publicly-traded stock. This is an important indicator that the valuation is justifiable and in line with market comparables. An advantage PIPE investors enjoy is that, unlike the sponsors and operating company shareholders, they are not under any lock- up provisions, so they are allowed to freely trade in the stock. Standard shareholders must adhere to a lock-up that prevents them from trading for the first 180 days the company is listed on the public market.

There are also some disadvantages to going public via a SPAC merger:

- Shareholder dilution: Sponsors typically own 20% of the SPAC.

- Possible capital shortfall: If investors in the SPAC are not excited by the deal and choose to redeem their shares, there will not be as much cash available.

- Compressed timeline to becoming a public company: The fact that merging with a SPAC is much faster than a traditional IPO is both an advantage and a disadvantage. The company has less time to get ready to comply with all the SEC requirements for a public company.

- No underwriting and comfort letter: In a traditional IPO, the underwriter verifies that the company is in compliance with all applicable regulations. Since the SPAC is already a public company, there is no underwriter.

Conclusion

SPACs raised over $80 billion in 2020, and in the first quarter of 2021 they raised more than $60 billion. Right now SPACs are hot, and we can expect to see more exits of venture-backed companies via SPAC merger than ever before.