Demand for high-tech employees 244% higher than 2020, but post-pandemic slowdown looms

Hybrid working increases

- Job vacancies at OurCrowd companies in Q3 2021 rise 244% year-on-year to more than 3,528; new daily vacancies rise from 31 to 47

- Most high-tech companies plan to slow down their hiring plans in 2022

- Hybrid work trend increases – more than 80% of companies expect hybrid working to continue into 2022, with employers in central Israel expanding recruitment in the periphery

- Software engineers, business development and operations specialists most in demand

- “We are increasing our hiring in R&D and sales. We moved to a hybrid model from complete working from home with new offices” – Kfir Kimhi, CEO, ItsMine

The OurCrowd High-Tech Jobs Index is a quarterly report and data series tracking vacancies and hiring patterns at high-tech companies in Israel and abroad. All data is based on a survey and the Portfolio Jobs section of the OurCrowd website, where more than 100 portfolio companies list current vacancies (4th edition: November 2021).

EXECUTIVE SUMMARY

Total job vacancies rise by 244% percent from Q3 2020 to Q3 2021

The total number of vacant positions advertised by startups in the OurCrowd portfolio rose by 244% year on year, from 1,024 at end of Q3 2020 to 3,528 at the end of Q3 2021. The number of companies in the portfolio reporting vacancies through the OurCrowd Jobs Page grew from 89 to 152 in the same period.

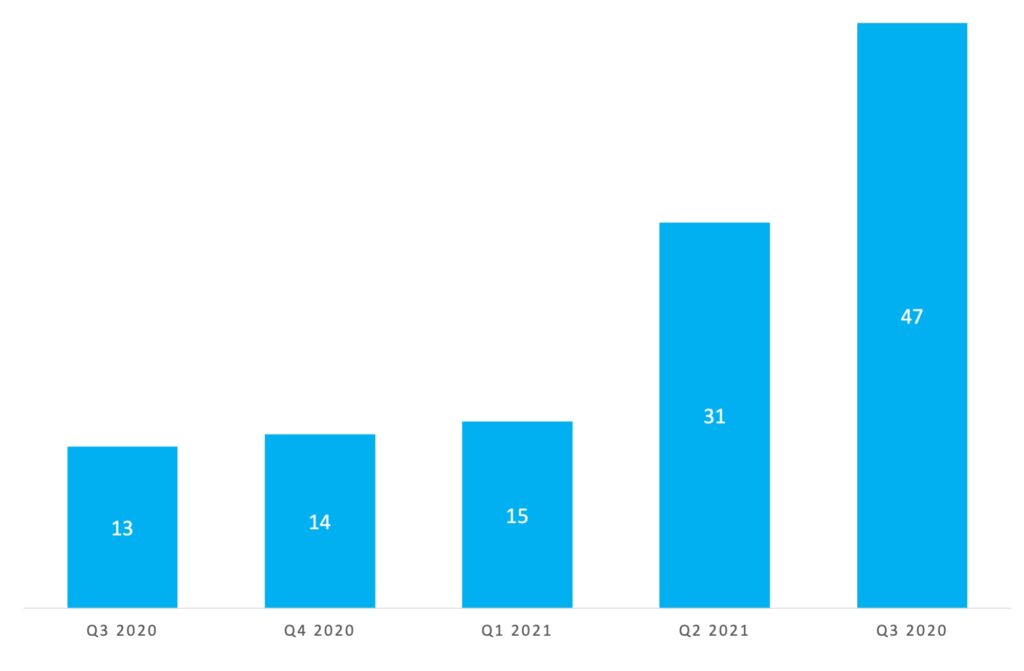

New daily job vacancies rise by over 50% from Q2 2021 to Q3 2021

The daily number of new vacant positions advertised by startups in the OurCrowd portfolio rose dramatically from 31 per day in Q2 2021 to 47 per day in Q3 2021, an average daily rise of 52%, with the number of companies in the portfolio reporting vacancies through the OurCrowd platform growing from 148 to 152.

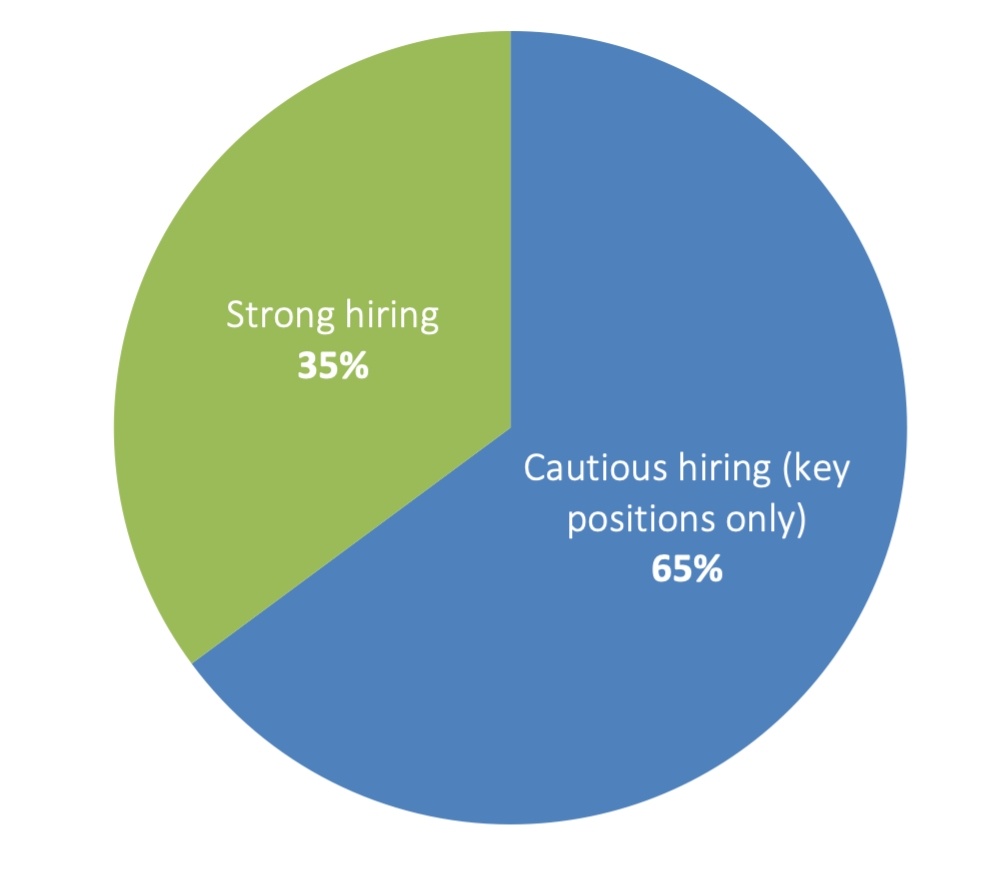

Companies predict hiring slowdown in 2022

The post-pandemic hiring spree will slow down in 2022. 65% of surveyed portfolio companies say they hired more aggressively in Q3 2021 than the same period the previous year when the pandemic was at its height.

“We managed to recruit 18 new employees, experiencing 40% growth in Q3,” says Daphna Keinan Mor-Haim, Head of HR at Shield.

“We grew the team from 10 to 17 people,” says Lior Tal, CEO of Kaholo.

But the same percentage say they plan to hire only for key positions in 2022. 56% of firms saying they will continue to hire sales teams overseas.

Most companies now working hybrid – expect to continue in 2022

84% of companies surveyed now have their employees working in hybrid mode; the overwhelming majority, 81% of all companies, expect that to continue in 2022. More than a quarter of those surveyed located in central Israel said they had increased hiring from peripheral areas, with more than 80% of employers happy for far-flung employees to work remotely.

“We are increasing our hiring in R&D and sales. We moved to a hybrid model from complete working from home with new offices,” says Kfir Kimhi, CEO of ItsMine.

“We are adjusting to working remotely,” says Ravit Menachem, HR and Office Manager at D-ID.

Physical expansion negatively impacted by pandemic

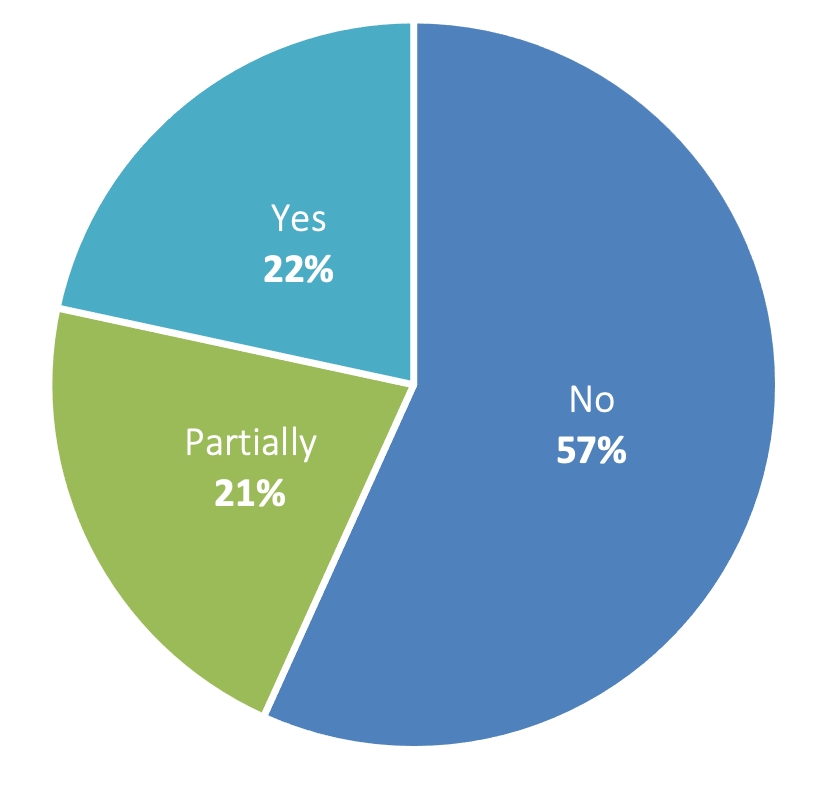

43% of companies surveyed reported the pandemic had at least partially impacted their plans to physically expand their business.

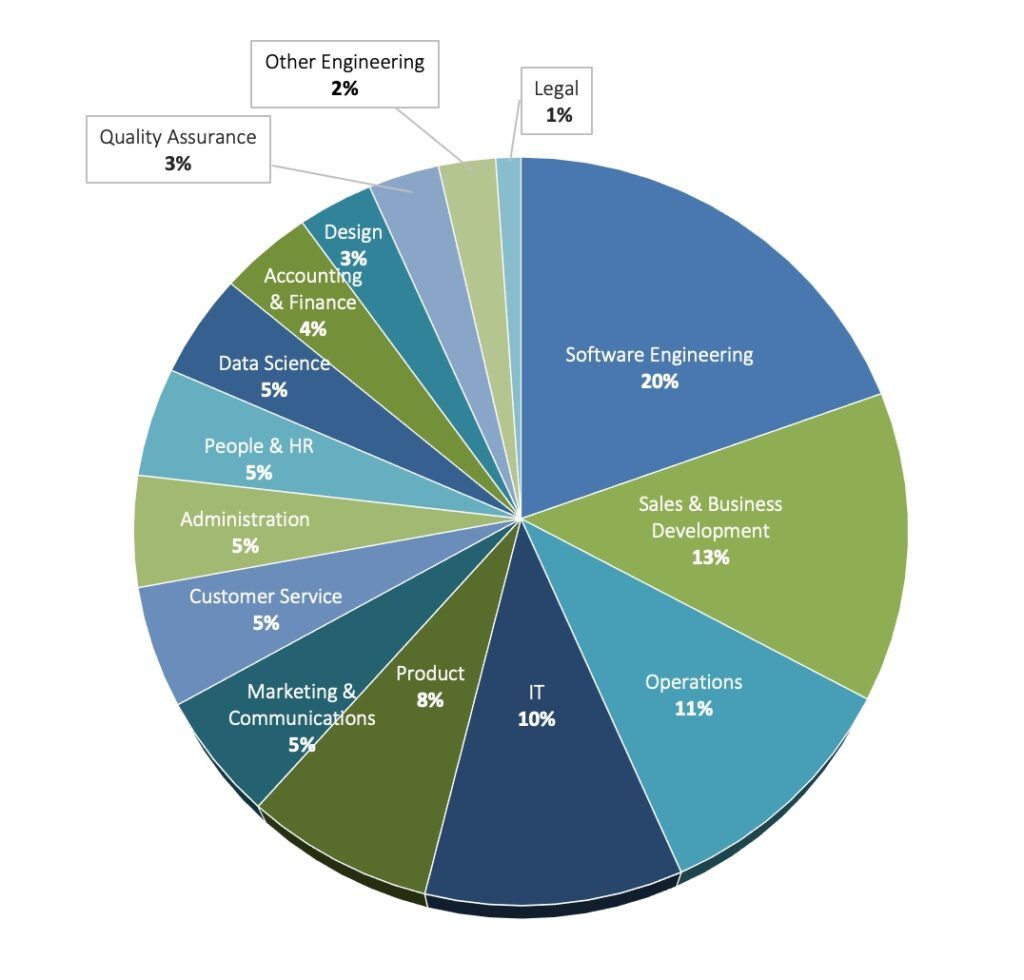

Software engineers, business development remain most in demand

Continuing the 2021 trend, in Q3 2021, software engineers remain the most in-demand category, with 20% of openings. Business development staff come in second with 13% while 11% of positions in demand were in Operations.

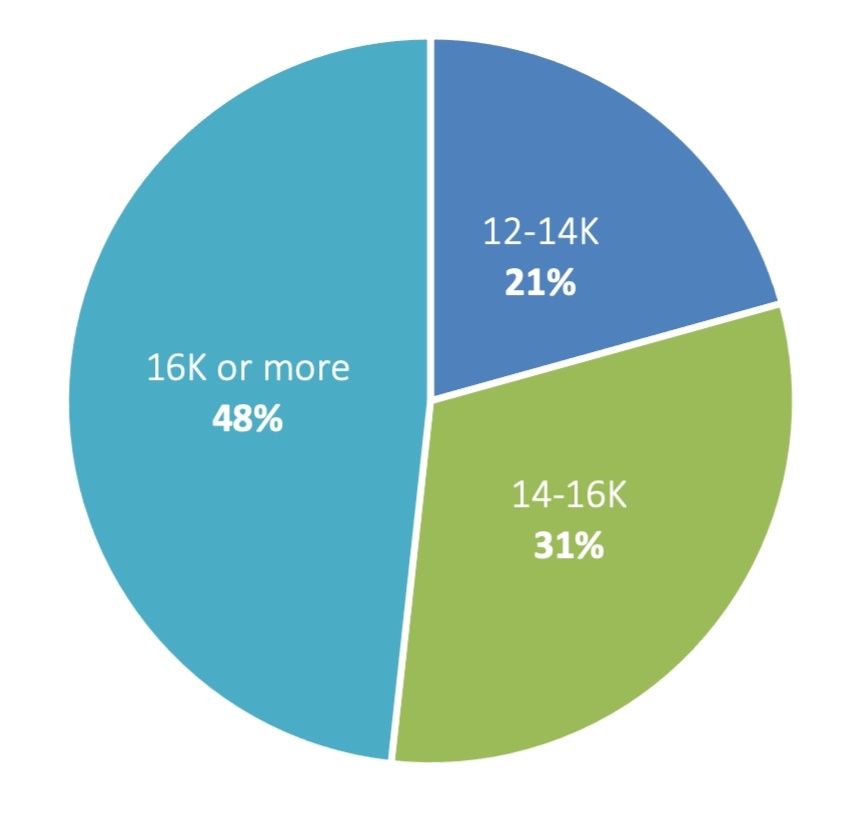

In Israel, 21% of entry-level product professional positions (up to 2 years’ experience) earn NIS 12-14K/month, 31% earn NIS 14-16K/month and 48% making over 16K/month. The average salary in Israel for all sectors is NIS 11,800/month. The average salary in Israel for the high-tech sector is NIS 26,500/month.

“It has become increasingly difficult to source talent and benchmark what their compensation should be,” says Amit Keren, CEO and Co-founder of Flowhow.

SURVEY FINDINGS

1. Total number of vacancies in OurCrowd portfolio companies

1A. Average number of new vacancies added daily: Q3 2020-Q3 2021

The number of new vacant positions advertised each day by startups in the OurCrowd portfolio rose dramatically from 31 per day in Q2 2021 to 47 per day in Q3 2021, an average increase of more than 51%. The number of portfolio companies reporting vacancies through the OurCrowd Jobs Page grew from 148 to 152 in the same period. Between Q3 2020 and Q3 2021 the daily number of vacant positions advertised rose by 271% year-on-year, while the total number of vacant positions advertised by OurCrowd startups rose by 244% from 1,024 at end of Q3 2020 to 3,528 at end of Q3 2021. The number of companies reporting increased during the same period from 89 to 152.

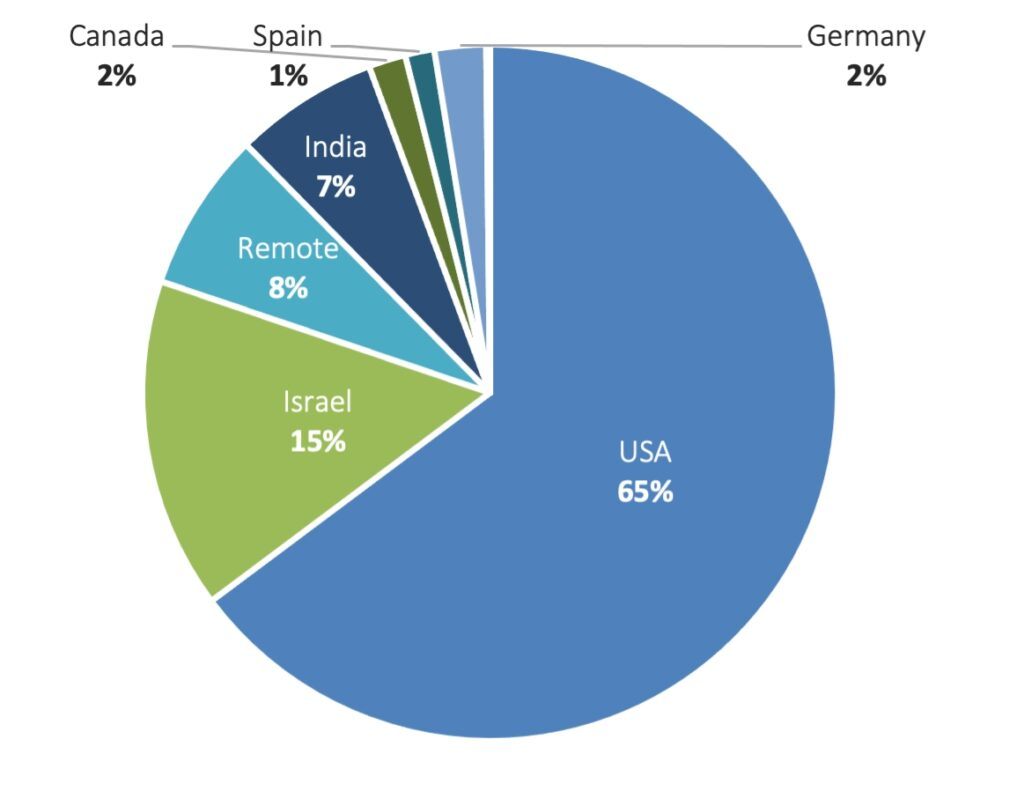

1B. Location of OurCrowd portfolio companies’ job vacancies

Almost two thirds of the jobs posted during Q3 2021 were based in the United States, about a seventh were in Israel, and just under a tenth were posted as fully remote jobs.

2. Companies’ plans for hiring in 2022

With the pandemic in retreat what is your company’s hiring growth plan for 2022?

2A. Companies’ hiring plans for 2022

Nearly two thirds of OurCrowd portfolio companies surveyed in in Q3 2021 say they plan to hire cautiously in 2022, looking to fill key positions only, while a little more than a third plan more aggressive recruitment campaigns next year. This is a stark difference from the previous quarter’s survey responses. In Q2, 61% of companies said they planned to hire strongly for the remainder of 2021.

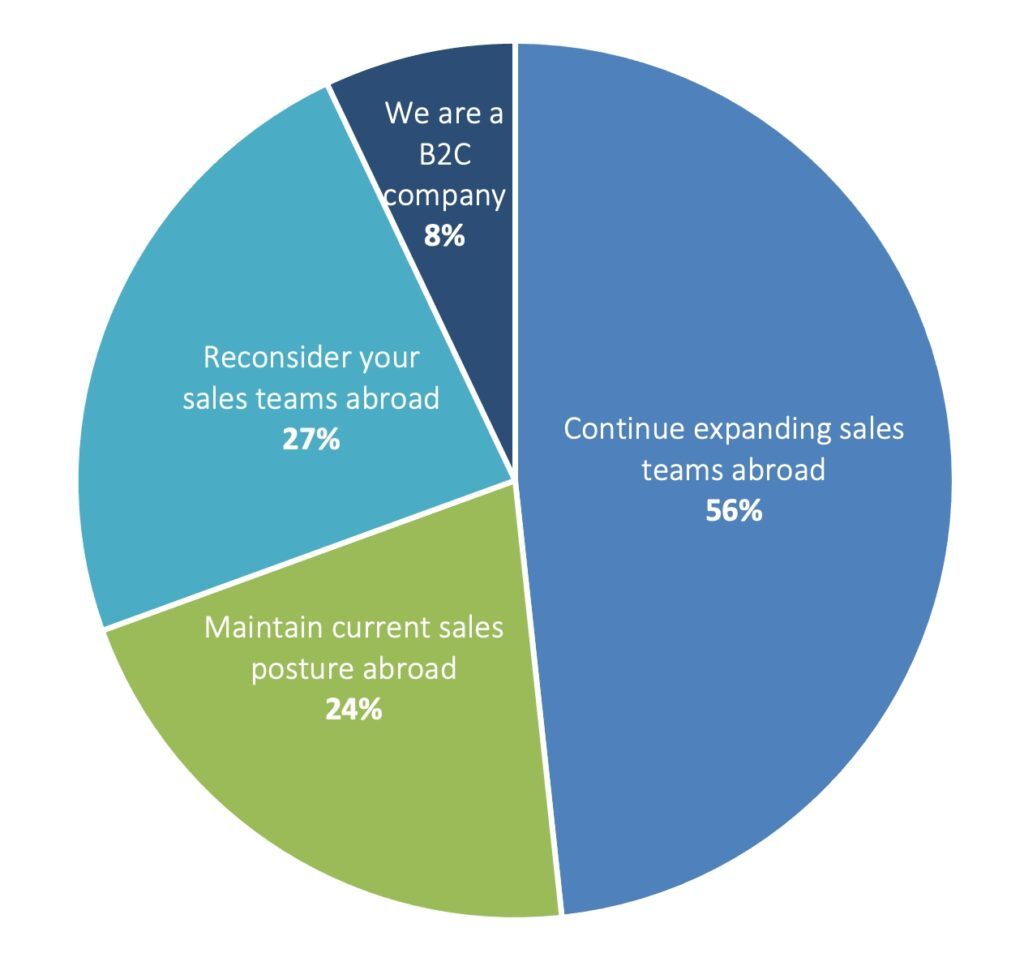

2B. Companies’ overseas sales hiring plans

Covid demonstrated that B2B deals abroad can be sourced and closed from one location. In the Zoom era has Covid caused you to:

More than half of OurCrowd portfolio companies surveyed in Q3 say they plan to expand hiring of sales teams overseas. Nearly a quarter intend to maintain their current overseas sales posture, while just under a quarter are reconsidering their sales teams abroad.

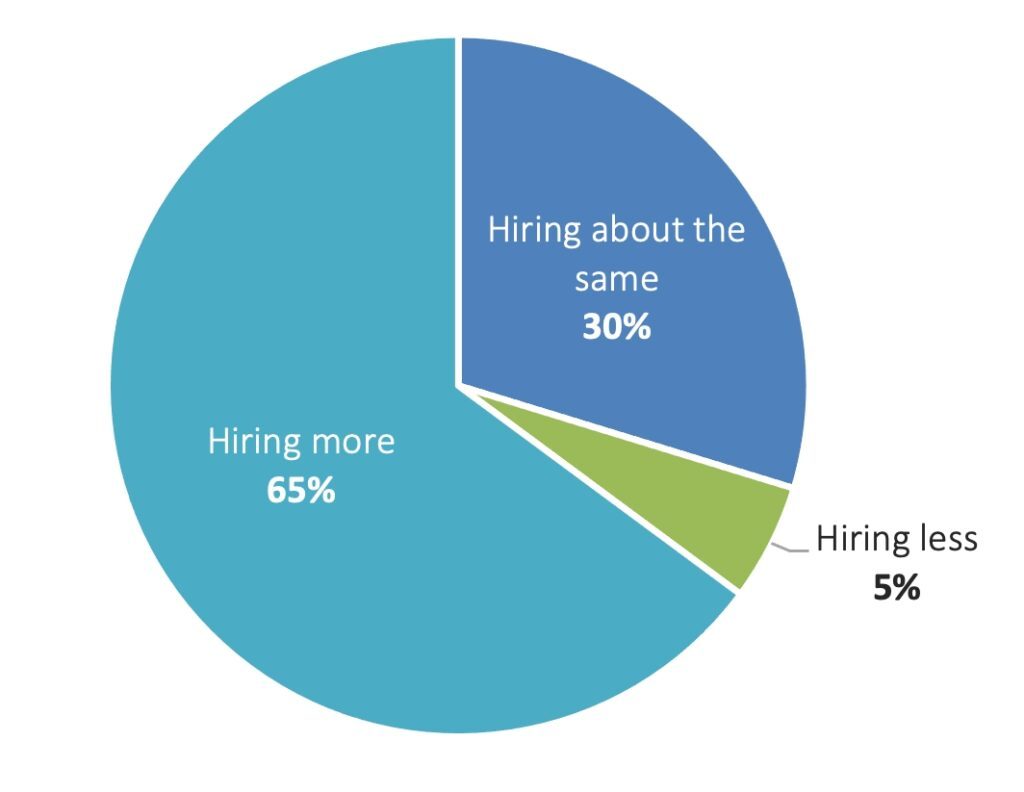

3. Hiring patterns in Q3 2021 compared to Q3 2020

3A. Companies’ hiring patterns

Compared to this period one year ago, is your company:

More startups are growing or maintaining their current staffing levels than in the previous quarter.

Nearly two thirds of OurCrowd portfolio companies surveyed in Q3 say they are hiring more staff now compared to the same period last year, while only 5% are hiring less. When asked the same question in Q2 2021, 61% said the company was increasing its staff, 26% said they were hiring the same number, and 13% were hiring less.

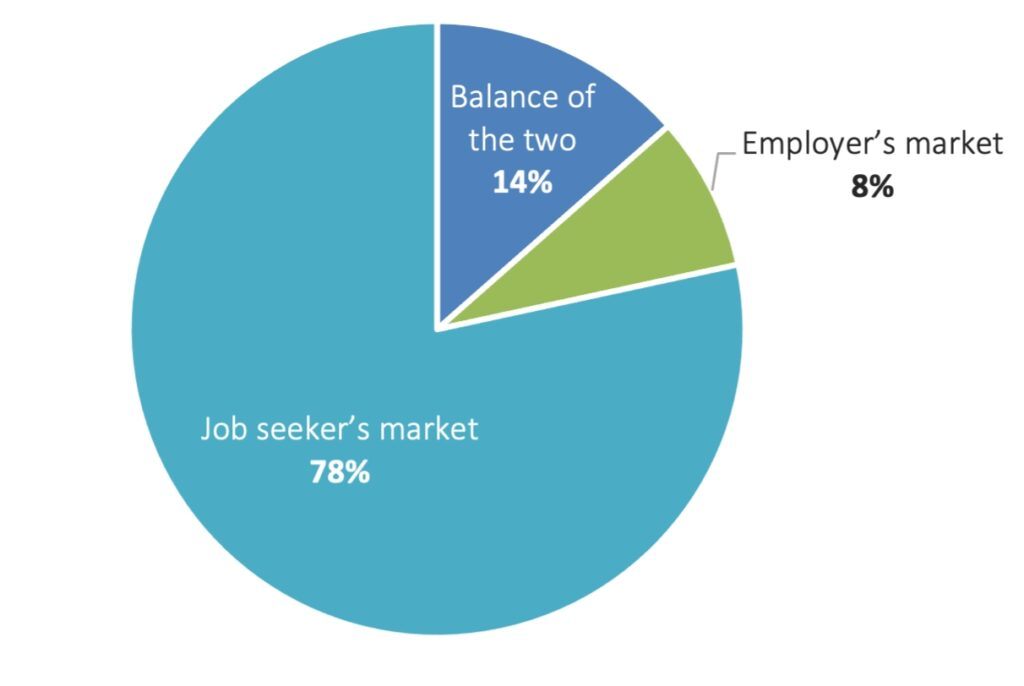

3B. Market for job seekers or employers?

Based on the hiring needs of your company and the quantity/quality of candidates that you are seeing, is the current job market a:

More than three quarters of companies surveyed in Q3 consider the current conditions in high tech to be a job-seekers’ market – a 10 percentage point jump from Q2. Just under a tenth say the market favors employers.

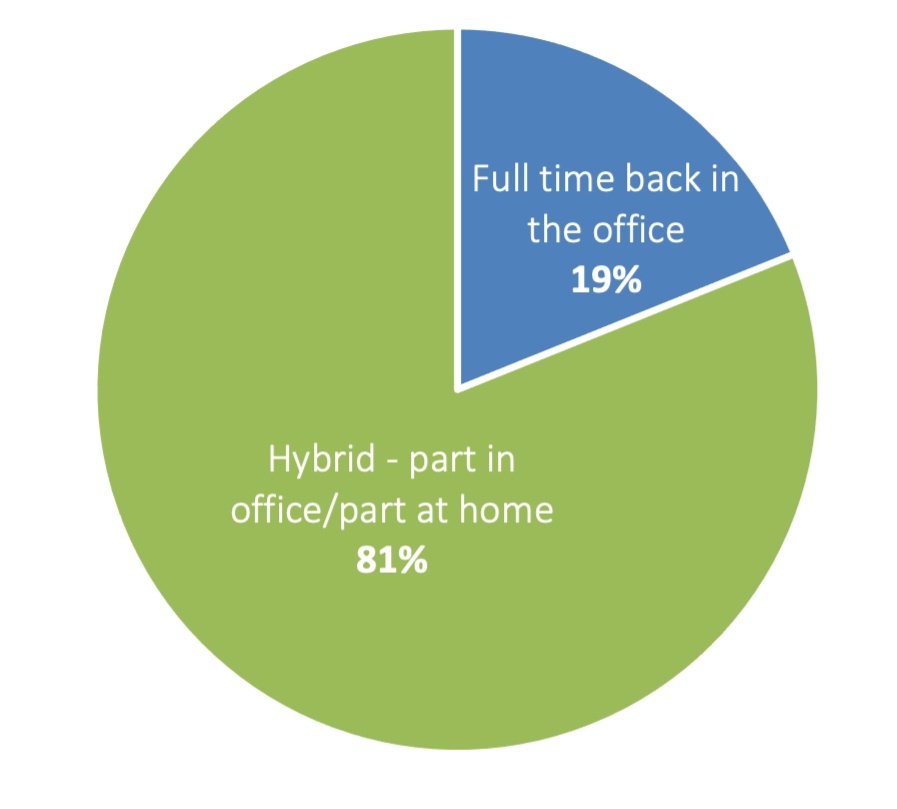

4. Remote vs. on-site work

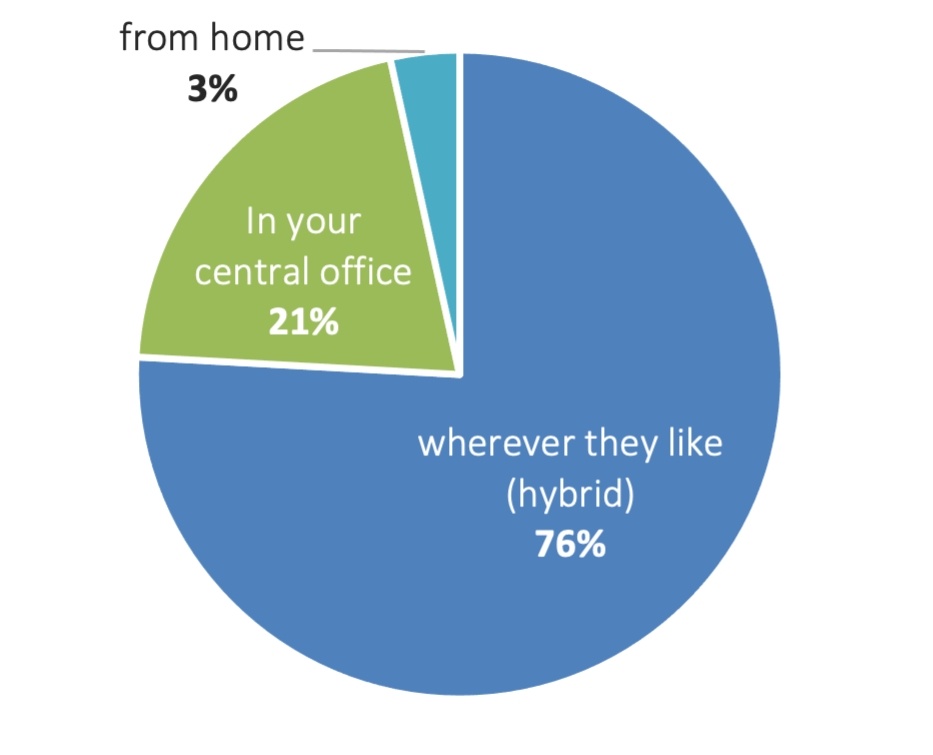

4A. Plans for remote vs. on-site working

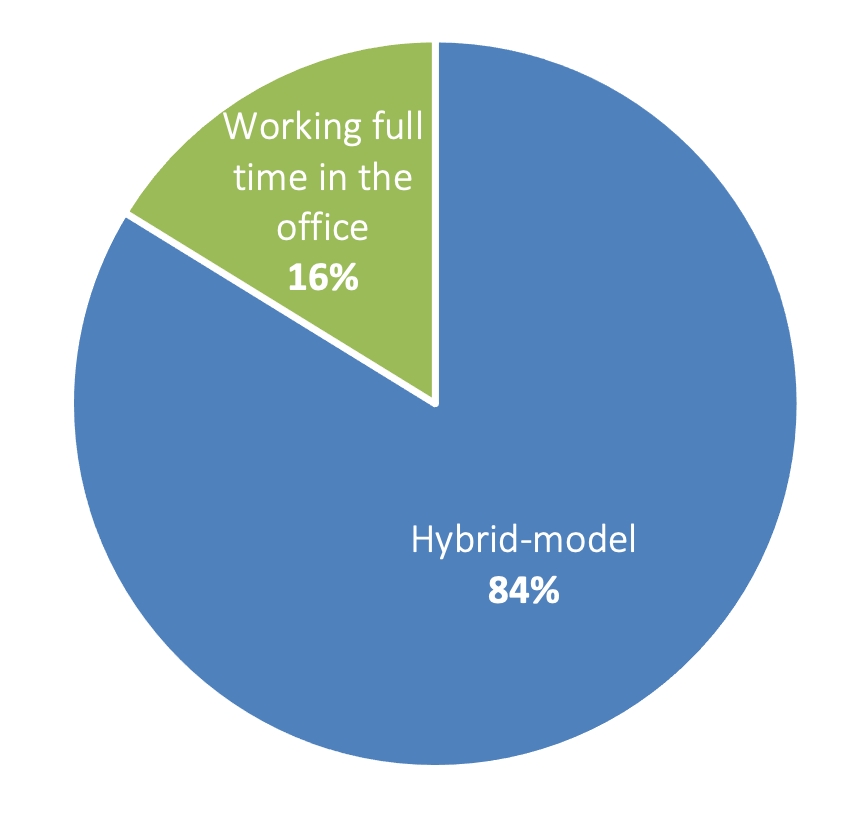

With Covid regulations now relaxed, in 2022 do you expect your employees will be working back at the office or a hybrid between the office and home?

Even though Covid regulations are easing and vaccinations are rolling out across the world, the proportion of startups expecting their staff to return to the office full time fell to 19% in Q3 2021 from 23% in Q2. 81% of companies expect hybrid working to continue into 2022, up from 77% in Q2.

4B. Working from home or office?

If your office has reopened, are your employees currently:

With all OurCrowd companies re-opened in Q3 as the lockdown eased, the dominant workplace model continues to be hybrid, with employees in more than four out of five of companies dividing their time between the office and other locations, including home. The proportion of workplaces operating a hybrid working model rose slightly to 84% from 81% in the previous quarter, but the percentage of offices returning to full-time onsite work also rose – to 16% in Q3 from 13% in Q2.

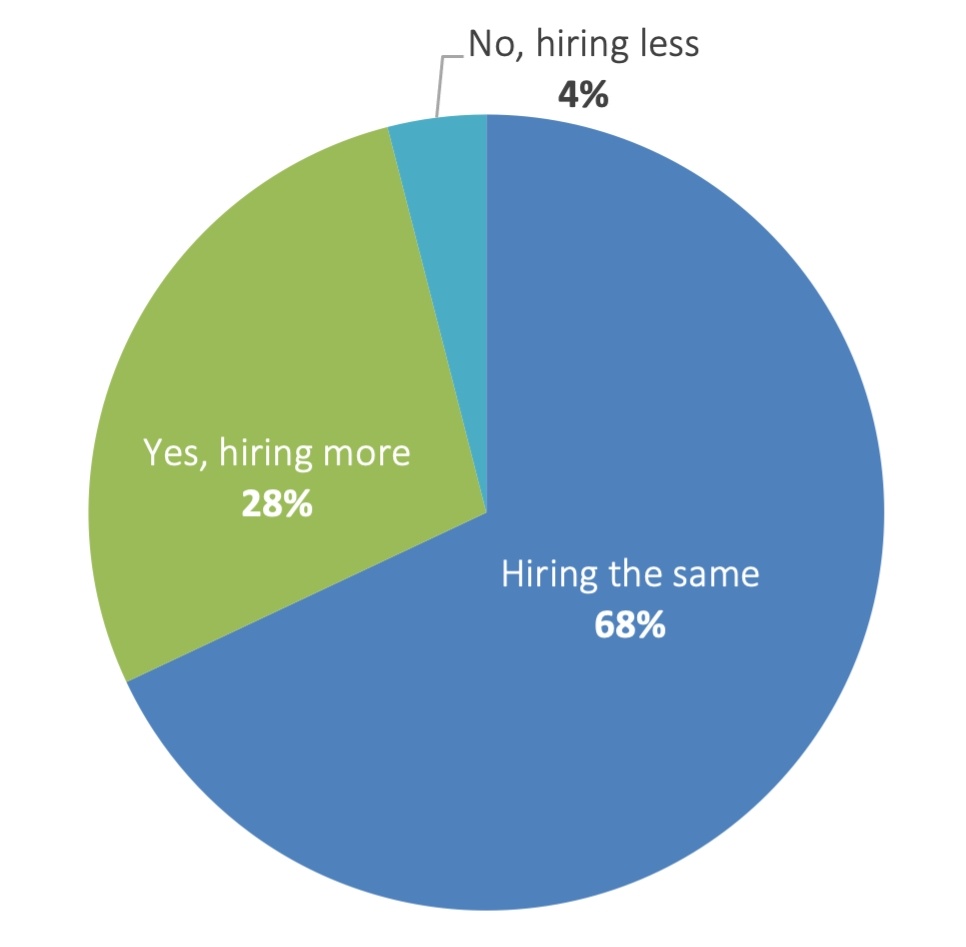

4C. Readiness to hire employees from the periphery

If you are located in the Center, has your readiness to hire employees from the periphery changed?

The success of remote work during the pandemic has led 28% of OurCrowd companies in central Israel to view more positively the prospect of hiring employees from the peripheral areas of Israel beyond the traditional high-tech triangle of Tel Aviv-Haifa-Jerusalem. 68% said their attitude toward hiring employees from the periphery has not changed, leaving only about 4% of our portfolio companies that do not seem enthusiastic about extending the geographical location of their staff.

Where are workers from the periphery expected to work?

Just over three quarters of the OurCrowd portfolio companies surveyed say they expect staff from the periphery to work from wherever they like. About one in five employers expect workers from outying areas to come into the office every day.

5. Demand for different positions

Which professional roles are in increased demand?

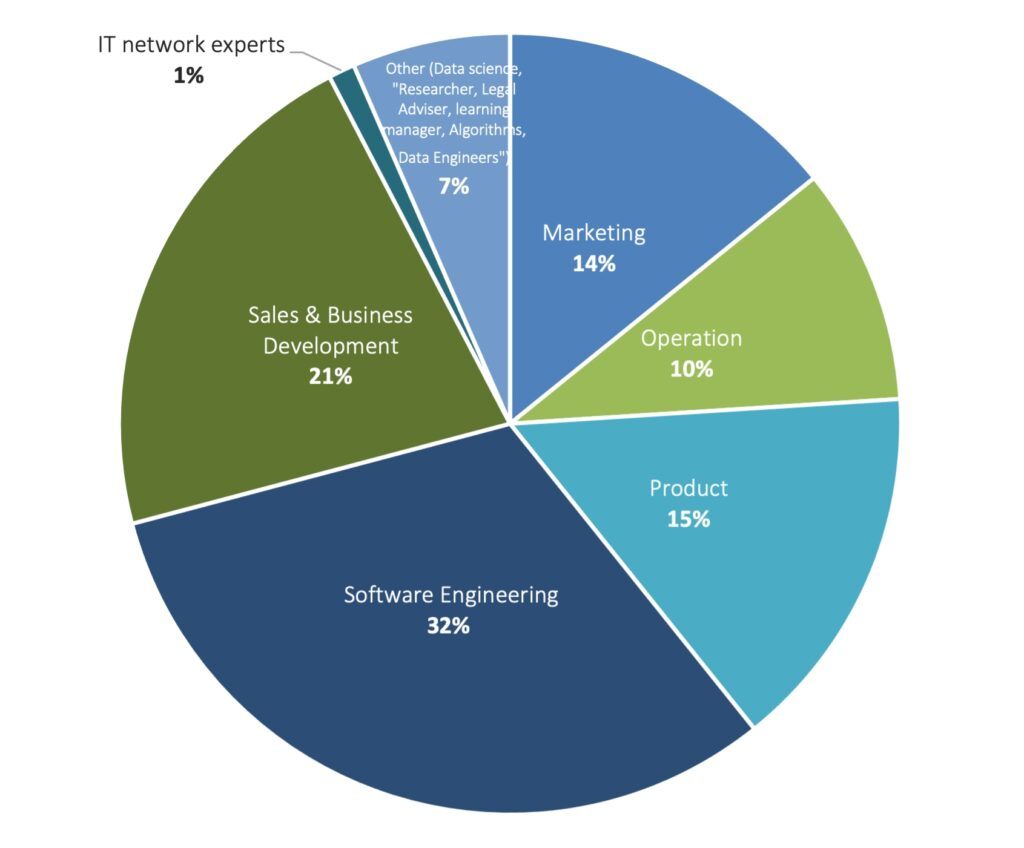

5A. Job vacancies posted Q3 2021

The positions most in demand in Q3 2021 were Software Engineering, Sales & Business Development and Operations, as in Q2. The demand for software engineers increased to one fifth of all job vacancies posted.

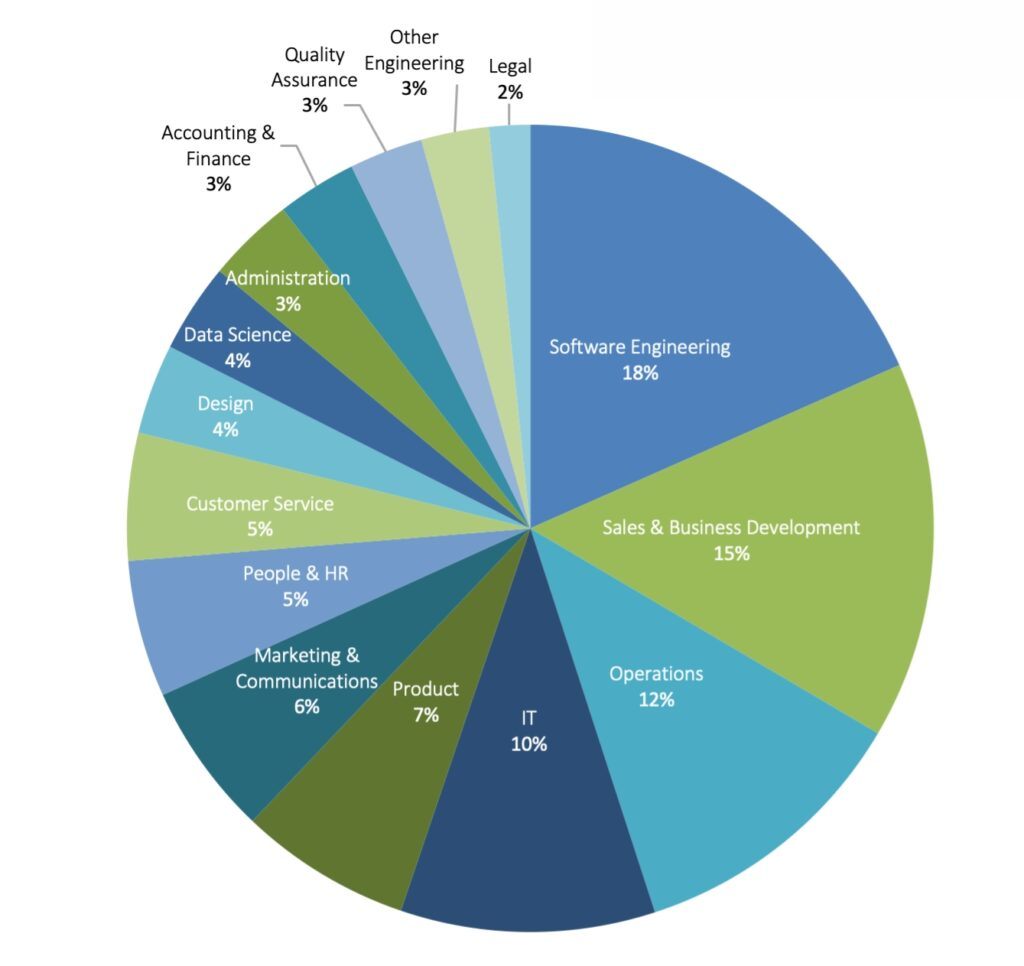

5B. Job vacancies posted Q2 2021

5C. Active hiring departments in Israel

Which departments are you hiring for in Israel?

Of the OurCrowd portfolio companies surveyed in Q3, nearly a third are hiring for Software Engineering and just over a fifth are recruiting for the Sales and Businesses development department.

6. Salaries: Product professionals

Product-related professionals are the fifth-most in-demand job role, according to the OurCrowd Q3 survey. In your company, what is the average monthly salary range in New Israeli Shekels (NIS) for:

6A. Entry-level product professional

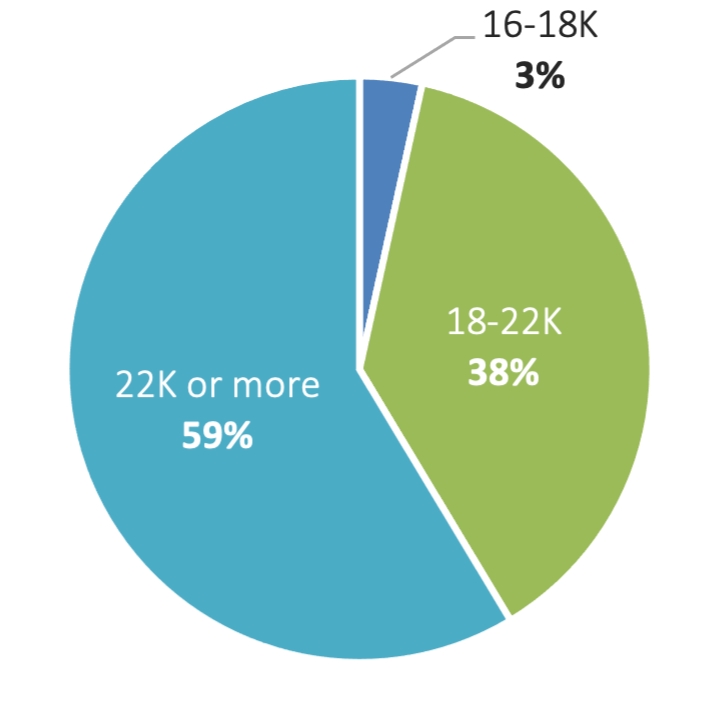

6B. Mid-level product professional (3-5 years)

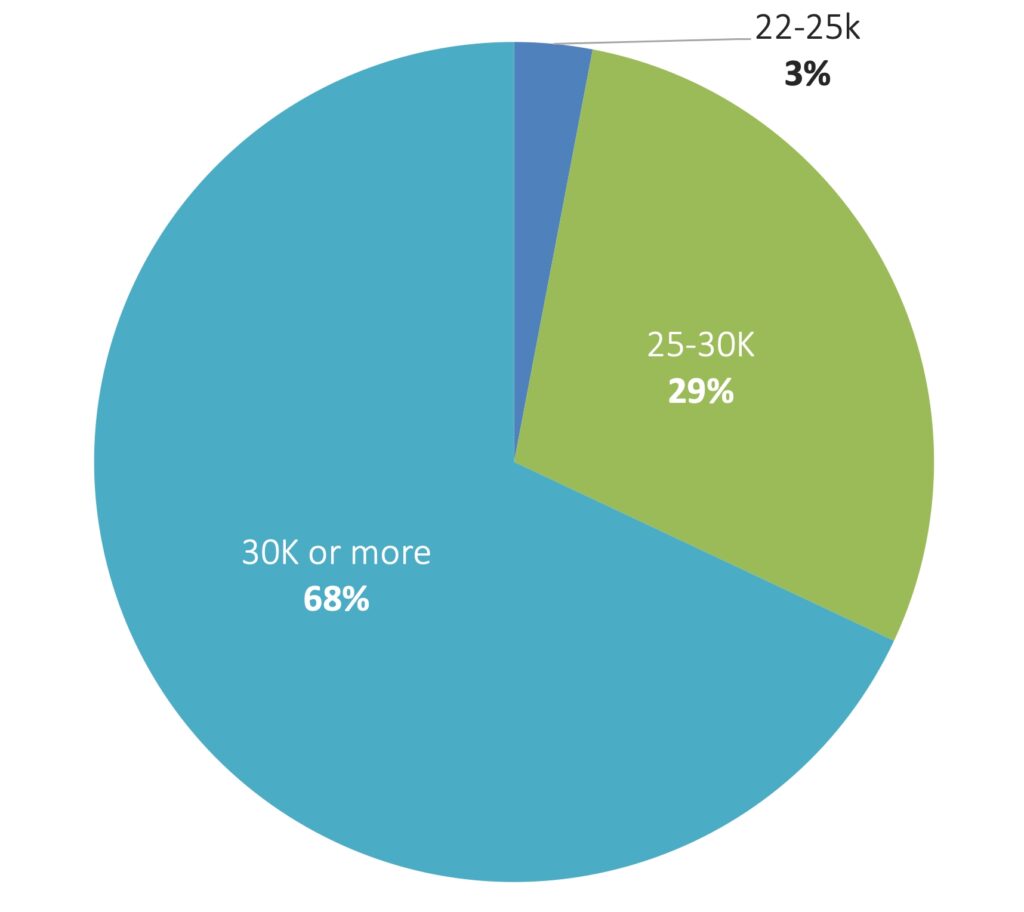

6C. Senior product professional (7-10 years)

Most entry-level product staff in Israel can earn at least 12,000 NIS/month and over a fifth earn more than 16,000 NIS/month. Nearly three fifths of mid-level product employees earn more than 16,000 NIS/month, while nearly seven out of ten senior product executives earn at least 22,000 NIS/month or more. As of August 2021, the average Israeli salary is about 11,800 NIS/month. The average Israeli high-tech salary is about 26,500 NIS/month.

7. Pandemic’s impact on physical expansion

Has the pandemic delayed your physical expansion?

The majority of OurCrowd portfolio companies say the pandemic had no impact on their expansion plans, while 43% say it had at least some impact.

8. Pandemic’s impact on physical expansion

Portfolio companies with the most clicks on their jobs ads in Q3 2021

Cloud-based directory software simplifies and unifies identity management, enabling secure connection to workstations, networks, apps, and files from any location.

Control center for event planning and attendee experience that consolidates logistical, promotional, and social tools.

A modern, tech-enabled healthcare company transforming the primary care and urgent care experience

The OurCrowd High-Tech Jobs Index is a quarterly report and data series tracking vacancies and hiring patterns at high-tech companies in Israel and abroad. All data is based on a survey and the Portfolio Jobs section of the OurCrowd website, where more than 100 portfolio companies list current vacancies. © OurCrowd 2021