As discussed in part 1 of this post on How To Value A Startup, valuing a pre-revenue stage startup is an art in and of itself. But, once a company has revenue, even if minimal, it becomes yet another factor worth considering in its valuation.

The question becomes: Just how important, if at all, are early stage revenues in determining an accurate valuation?

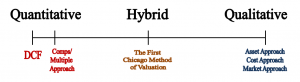

When it comes to valuing startups with revenue, there are 3 basic schools of thought:

- Quantitative: A company’s value is based heavily/solely on future cash flows – its ability to make money in the future.

- Hybrid: The ability to make money in the future is important, but there are other value-based metrics that also contribute to an accurate early stage valuations.

- Qualitative: Projecting a company’s future cash flows is a waste of time as it is not only inaccurate, but unrelated to its current valuation.

The 1st School of Thought: Quantitative

The following methods are based on the assumption that people value a company based on its ability to earn money in the future.

DCF (Discounted Cash Flow)

DCFs are about as standard a valuation tool as one can find in the more mature equity markets – stocks. For non-numerically oriented individuals, DCFs can look quite intimidating. But, if you can get past the overwhelming expanse of numbers, or even if you can’t, the purpose of a DCF is straightforward: to arrive at a valuation based on the current value of projected future cash flows. These projections are based on current financial information (found in the various financial statements).

In plain English: Determine at what rate (%) you think the company will grow over the next few years, take into account that startups are highly unpredictable, and arrive at a valuation.

Below is a summary of the features of a basic DCF.

(For a more detailed breakdown click here)

Step 1 – Project Future Earnings

Take an educated guess as to how much the company will grow (%) over the next five or so years. Unfortunately, this too is an art.

(For other factors to consider, click here)

This will allow you to estimate sales/revenues, costs, and taxes etc… After deducting all projected costs from revenues, you will arrive at “projected future earnings.”

- Tip: analysts run multiple DCFs to get a range of valuations.

Step 2 – Discount Projected Future Earnings

Discounting is the process of assigning present values to future earnings. In non-financial lingo: How much, in today’s dollars, are future revenues worth?

Discounting accounts for two factors:

- Inflation (Time-Value of money): $1 million today is not worth the same as $1 million in 10 years from now (view estimates here).

- Startup specific uncertainty: Since startups by definition lack a track record, predicting future cash flows with any degree of certainty is next to impossible (click here for information on how to do this).

As such, discount rates as high as 30-60% are not uncommon when dealing with startups.

Step 3 – Calculate the Terminal Value

The Terminal Value is simply the value of the business at a certain date in the future once the company has reached a level of stability and the growth rate is less volatile.

You might ask: Why would we assign an end to forecasting?

The answer is quite simple. As a startup matures and becomes a full-fledged business, it will (in the vast majority of situations) no longer experience tremendous, unpredictable growth. At this point it is more appropriate to view the company as a stable entity with more predictable revenue streams and a fixed growth rate.

| Terminal Value = | Final Projected Year Cash Flow * (1 + Long-Term Cash Flow Growth Rate) |

| (Discount Rate – Long-Term Cash Flow Growth Rate) |

Step 4 – Arrive at a valuation

The valuation is simply the sum of the present values (achieved by discounting) of the Terminal Value and the Projected Future Earnings.

DCFs are good because they directly address 2 key questions:

- How much will the company earn in future years?

- How much are those earnings actually worth today?

DCFs are bad because:

- Even a 1% change in any assumption can have a significant impact on the bottom line and therefore on the valuation.

- Value investors contend that DCFs are useless; as the old mantra goes “past performance is not necessarily an indicator of future success.”

- In the startup world, this argument resonates even more as the bulk of the value in a startup is from revenues that have yet to occur.

As you have probably gathered, DCFs are more likely to be accurate when there are predictable cash flows. Therefore, the general sentiment is that DCFs are not incredibly useful as a standalone tool for startup valuation.

Comps/Multiple Approach

In financial analysis, financial ratios are used as indicators. Some of the more popular price related ratios/multiples include:

- P/E – Price/Earnings

- P/S – Price/Sales

- P/EBIT – Price/(Earnings Before Interest and Taxes)

- P/EAT – Price/(Earnings After Taxes)

- P/BV – Price/Book Value

- P/CF – Price/Cash Flow

In the above ratios, the price (value) of your startup is simply a function of a certain multiplier of some variation of earnings, sales, book value, or cash flow.

Quick Tip: use multiple sector-specific comps to get a valuation range. Don’t rely on any one single comp alone.

The Good: Arrive at a simple numerical valuation based on your current financial situation.

The Bad: Very difficult to find appropriate comps.

The 2nd School of Thought: Hybrid

The First Chicago Method of Valuation

This hybrid method utilizes the quantitative nature of a DCF to project cash flows for the next 5 (sometimes even up to 10) years when the company is assumed to exit or shutdown. At that date, the company’s value is thought of as a multiple of earnings (or something similar) based on what comparable companies exited at.

The procedure is as follows:

- Project three scenarios: a best, a worst, and an expected

- In the example they are titled: Failure, Normal, and Success

- Assign each scenario an appropriate weight (based on market conditions)

- Forecast out the cash flows for each scenario until Exit (same process as DCF)

- In our example 5 years

- Use market comps to determine an exit (can use multiple comps)

- In the our example EAT (Earnings After Taxes is used)

- Discount the Exit to get

- Failure = $1 million/(1.40^5) = $185 k

- Normal = $40 million/(1.40^5) = $5.26 million

- Success = $120 million/(1.40^5) = $22.31 million

- Reach a weighted average valuation

- For example if you forecasted 3 possible outcomes, and based on your calculations concluded the following situation after 5 years:

| Startup State | Weight | EAT | Multiplier | Exit | Discount Rate | Discounted Exit |

| Failure | 30% | $0 | *$1 million | $185 k | ||

| Normal | 50% | $4 million | 10 | $40 million | 40% | $5.26 million |

| Success | 20% | $6 million | 20 | $120 million | 40% | $22.31 million |

* the company is liquidated –and everything they own is sold off

Your company’s weighted average valuation would be:

.30*(185,000) + .50*(5,260,000) + .20*(22,310,000) = $7,147,500

In short, figure out where the company will be 5 years from now? Based on that answer, see what comparable companies with similar numbers exited for.

The Good: Reach a definitive Valuation based on a hybrid of quantitative and qualitative analysis.

The Bad: Still relies pretty heavily on early Cash Flows.

The 3rd School of Thought: Qualitative

One of the more blunt qualitative valuation approaches is that of Dave McClure, founding general partner at 500 Startups. He simply has 5 “Million Dollar Points”. If a startup has all 5 of these points then it is worth $5 million. While this example is rather extreme, there are many approaches that rely on qualitative factors to determine a startup’s value. They include:

1) Asset Approach – If you have taken a course in accounting, you might remember this one.

The basic idea is that it is best to place objective values on all assets. This will give you a very conservative baseline value.

Value Adders – The following three factors add value to the baseline value derived from assets:

- Intangible Assets – namely intellectual property

- Employees

- Customer traction

These factors all add value, but how much is very subjective.

2) Cost Approach – Simply how much would it cost someone else to start from scratch and reach the same point you are at now.

3) Market Approach – See what similar companies were valued at. This is also discussed in detail in part 1, but just to quickly reiterate 4 key considerations when finding the right comp:

- Hot Market

- Size of market

- Location

- Direct Competitors/Barriers to Entry

The bottom line: The distinct advantage of qualitative analysis is that value is a result of certain key qualitative factors. That being said, determining which qualities are key and how to value these qualities is totally subjective.

Putting Theory to Practice

While in theory, attributing significance to early revenues may seem appealing, successful angels tend to value early startups using more qualitative measures.

As Basil Peters, CEO of Strategic Exits Corps, says “My bookshelf has an entire section of books on valuation. Even though I deal with valuation every day, I haven’t looked at any of those books for at least a couple of years. It’s just not a process you need reference books for.” (AngelBlog)

>>>See part 1 of How to value a startup<<<

![Pop stars with startups, hi-tech ALS challenge, GetTaxi on Israeli advantage [OurCrowd Newsletter]](https://blog.ourcrowd.com/wp-content/uploads/2014/11/OurCrowd-Newsletter-banner1.png)