• Venture funds are joining the rush to renewable energy—and it’s not a passing fad

• Government subsidies will help, but innovative companies and business logic will drive growth

From the frozen electric grids of Texas to the tar-soiled beaches of Israel, the urgent need to transform our dependance on fossil fuels is becoming clear. You don’t have to be a tree-hugging naturalist to embrace the shift. Even the world’s largest oil producers have begun a strategic pivot toward renewables. In 2016, the Saudi government announced its Vision 2030 which it said aimed to end the kingdom’s “addiction” to oil and diversify its economy and energy sources.

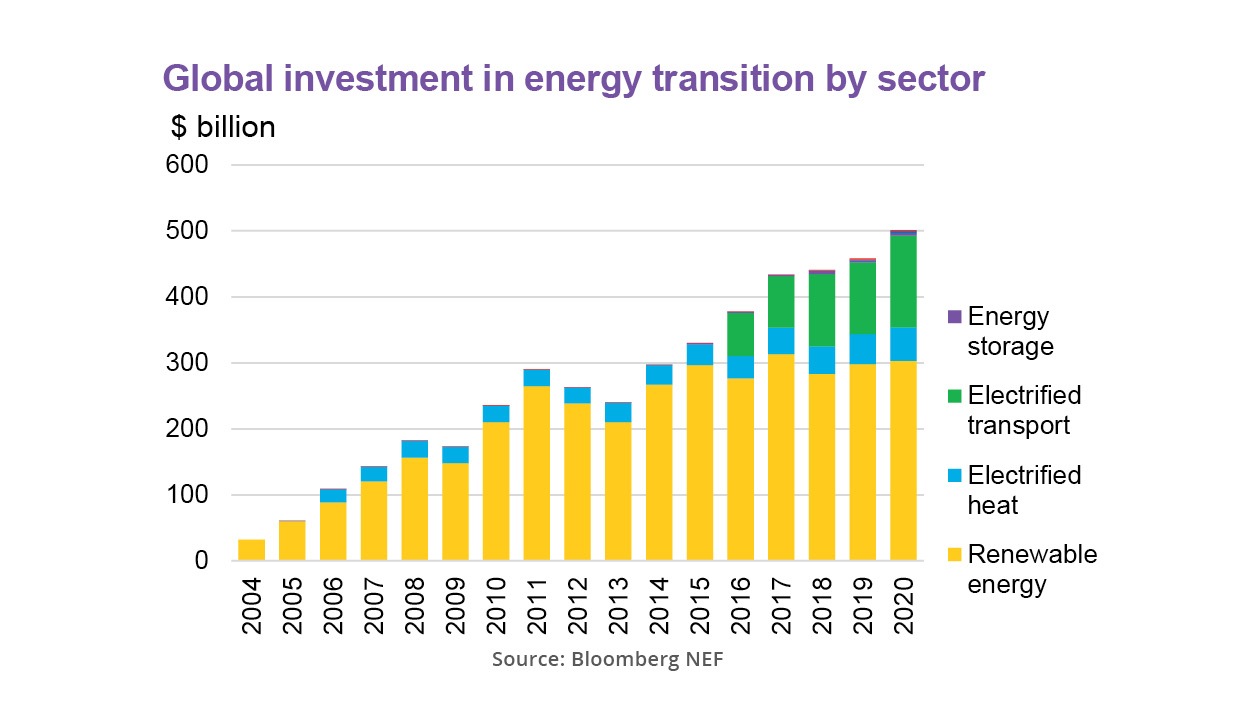

Venture investment in renewables has soared as global investment in energy transition more than doubled from $235 billion in 2010 to $501 billion in 2020, according to Bloomberg NEF. In 2019, venture and private equity investment in cleantech was estimated between $9 and $16 billion, up from less than $500 million in 2013.

Global oil companies like Shell, BP, Total and Repsol are investing unprecedented amounts to develop new solar, wind and other green energy technologies. A recent survey found that two-thirds of senior oil and gas professionals say their organization is actively adapting to a less carbon-intensive energy mix in 2021, up from just 44% in 2018.

Rush for Renewables

It is not by chance that governments and corporations that grew wealthy from carbon are looking to a fossil-fuel free future. New energy is good business. Just ask Elon Musk, whose 2004 bet on electric cars looked risky at the time and now seems prophetic. SolarEdge, a smart energy provider based in Israel, is now one of the country’s most valuable companies.

In the US, Enphase Energy, which provides solar power systems for private residences, has seen its stock triple in the past year. Venture funds that previously would never touch anything apart from software are joining the rush for renewables.

Bill Gates, Jeff Bezos, Prince Alwaleed bin Talal, Michael Bloomberg, Richard Branson, Reid Hoffman, Jack Ma and some of the world’s biggest and smartest investors, created Breakthrough Energy Ventures, a VC that invests in net-zero emissions technology and clean-energy startups.

Exciting Opportunities

At OurCrowd, we are investing alongside Breakthrough Energy in two companies seeking to harness new, clean-energy sources. H2Pro is developing production technology to enable the wide scale adoption of sustainable hydrogen fuel. It was founded by leading hydrogen experts at the Technion-Israel Institute of Technology with Talmon Marco, who previously founded iMesh, Viber and Juno. Dandelion Energy, which was incubated at GoogleX, is developing affordable geothermal installations for normal homes, harnessing the ground beneath your swing set and barbecue to heat and cool your house for a fraction of the cost of carbon-based systems. These developments are creating exciting opportunities for investors. As we expand OurCrowd’s activities in the United Arab Emirates, I am repeatedly asked about opportunities in renewable energy deals from investors who made their money primarily from fossil fuels.

The rush to renewables is not a passing fad. The new US administration’s $2 trillion infrastructure package is likely to accelerate the trend with potential tax breaks and subsidies encouraging the adoption of renewable technologies. This kind of stimulus reminds me that here in Israel, the government played a key role in the birth of the Startup Nation by incubating technology startups, and the Israel Innovation Authority continues to subsidize incubators and companies to encourage the development of new technologies that can benefit the economy and tech ecosystem. But, just as Israeli high-tech is accelerated by, though not dependent on, government subsidies, the same is true for renewable energy. Businesses that will drive and benefit from the global shift toward green energy will be innovative companies that are growing because of inherent business logic—rather than government policy.

First published in Prospective, quarterly perspectives on VC, technology and market trends published by OurCrowd. To join the Prospective mailing list, email prospective@ourcrowd.com.

Related: