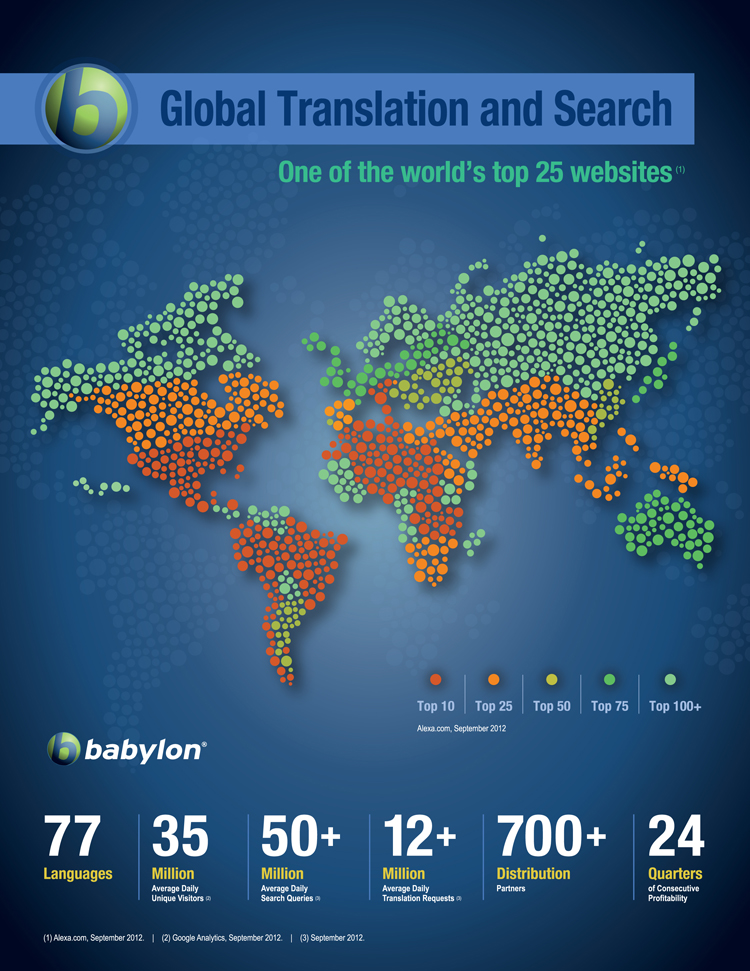

What Bablyon’s new IPO filing has to say about the Israeli economy and talent

Global translation software firm, Bablyon (I’m sure you’ve seen its ads) has just filed to raise $115M. The firm, already trading in Tel Aviv for years, will list on the Nasdaq under the ticker symbol “BBYL”. The Israeli hi-tech firm’s marketcap on the TASE is just over the equivalent of $410M. The firm’s been on fire — seriously boosting traffic and revenues to the site. The company said it receives over 30M daily unique visitors to the site (wow) and has been growing its revenues at a 66% CAGR the last 3 years. Talent, startups, and future Israeli IPOs Reading through company prospectuses — especially, the section with risks to their businesses — can be extremely educational (when we launch a startup for funding on our platform, we perform a similar analysis). Front and center in the Babylon F-1 is a statement about Israeli talent — the lifeblood of any startup. [bra_blockquote align=””]Our business relies on the significant experience and expertise of our senior management and technical staff and we must continue to attract and retain highly skilled personnel...

Read More