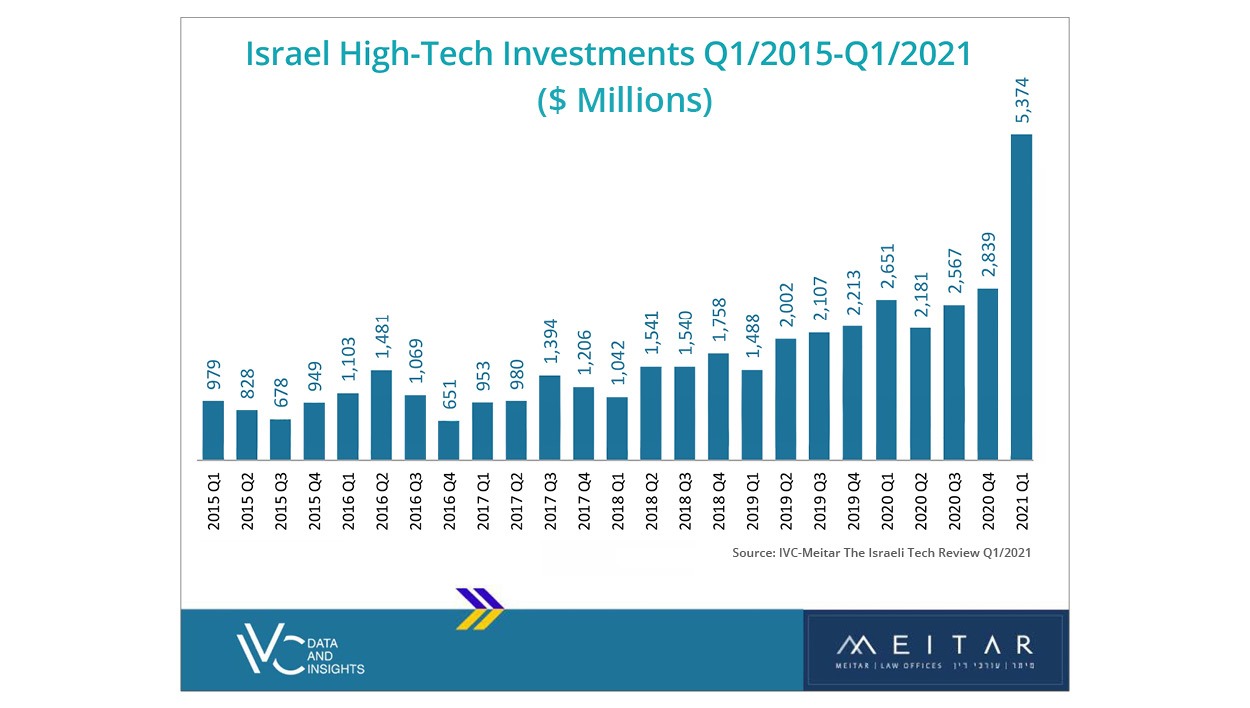

Record First Quarter for Israeli High-Tech Investments

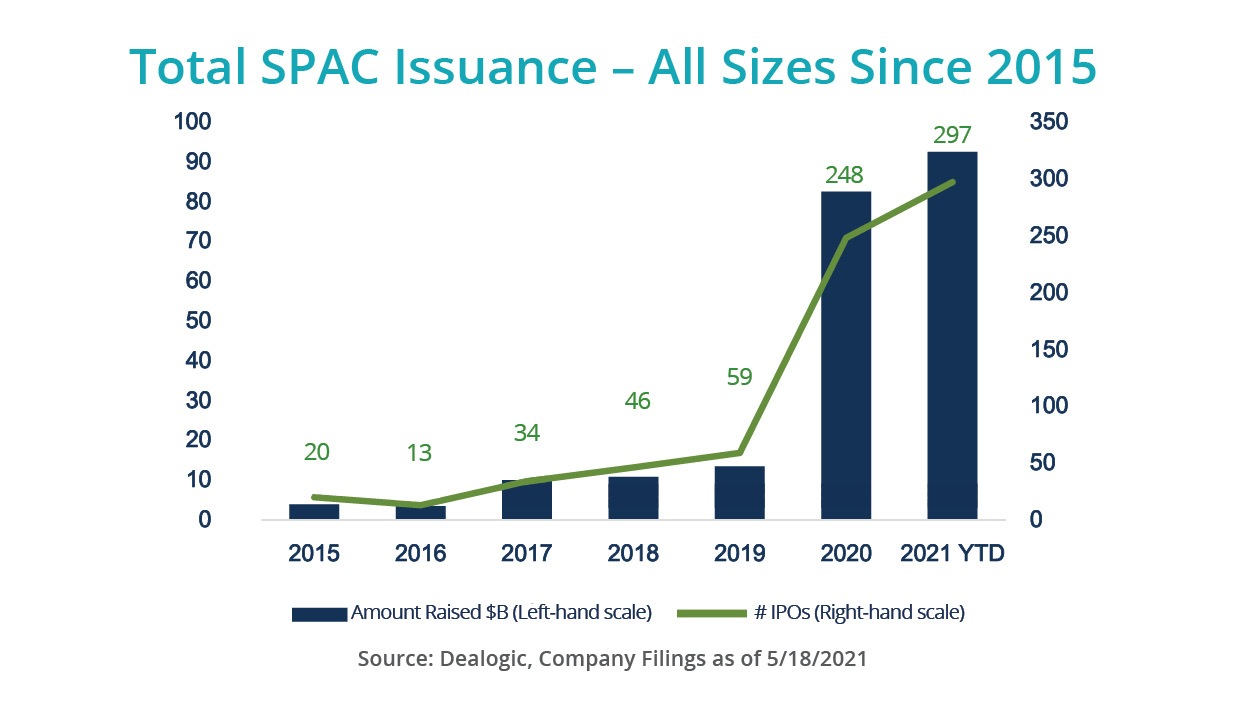

By OURCROWD Venture funding set to double over 2020 Capital raising by privately held Israeli technology companies soared to a record $5.37 billion in the first quarter of 2021, 89% higher than in the previous quarter and double the amount raised in the first quarter of 2020. The surge was driven by 20 deals worth more than $100 million each, accounting for 55% of the total quarterly amount raised in 172 transactions. During the quarter, the median deal size doubled to $10.3 million and the average nearly doubled to $31.2 million, signaling that most of the capital flow went to relatively few capital-intensive deals. First published in Prospective, quarterly perspectives on VC, technology and market trends published by OurCrowd. To join the Prospective mailing list, email prospective@ourcrowd.com. Related: SPACs Unpacked: What Investors Need to knowOurPeople: Alec Ellison, Chairman, OurCrowd USGreen Energy Makes Business...

Read More