In our fast-changing digital world — where new mobile apps continue to transform the way we live, work, and play — FinTech is reshaping how we handle our money online and on the go.

Take a look, just as an example, at peer-to-peer (P2P) money transfers and remittance, which are worth well over $1 trillion. Today, only a small part of those transactions – in the US, about $5 billion – are conducted via mobile.

But mobile transaction volume is likely to grow exponentially in the coming years —driven by FinTech innovation — such that (according to some estimates) P2P transactions could conceivably jump to $86 billion in the US by 2018.

With the future growth of FinTech intricately linked to mobile technologies, mobile payment solutions are an important piece of the puzzle.

Here are some of the ways that mobile apps are already redefining and reinventing how our money is being shared, received, and transferred via mobile.

All in the Family

It’s become more convenient to repay people digitally using P2P payment services, than to pay using cash. Some of the better known apps for splitting checks, paying the rent, settling up between friends, or lending money to family are PayPal, Venmo, Square Cash, and Google Wallet.

Signing up for these services is quick and free, with apps available for iOS and Android. The apps streamline the mobile payment process, often requiring only the email or mobile number of the recipient, and they may also be the cheapest way to send money — as many services are free.

Each app comes with its own advantages:

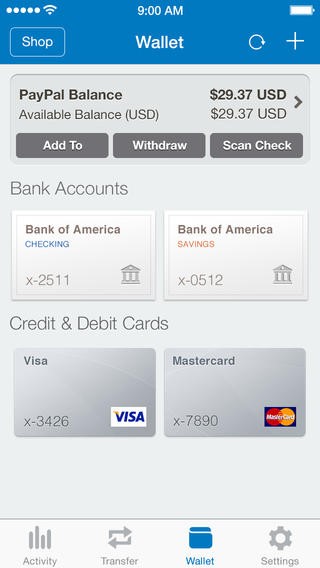

PayPal, the best known service, has a corporate, well-established reputation. It is unique in terms of size — in the first quarter of 2016 (according to their own statistics), PayPal’s net payment volume amounted to $81.06 billion — and global status, with full service in 203 markets and 26 currencies internationally. Founded in 1998, it’s a long-standing service that people adopted back in the days when eBay was the place to buy online, and PayPal was how you paid. PayPal allows transactions of up to $10,000, more than you can transfer using the competition. However, PayPal is frequently more expensive than the alternatives. Debit and credit card transactions incur a 2.9% fee plus a flat 30-cent fee — while other apps transfer money for free using linked debit cards.

Venmo, initially released in 2009 (and acquired by PayPal in 2013), is so popular among millennials that the verb “to Venmo” has taken off. Designed for payments to friends, Venmo has a social side to it — a newsfeed telling you who bought what — that other options lacks. In fact, its website states that the service “is designed for payment between friends and people who trust each other.” With Venmo, it’s free to send money from your bank account and from most debit cards (and it’s always free to receive money), but there’s a 3% fee on credit cards and on some debit cards. The company, which processed $2.1 billion in transactions in the third quarter of 2015, may be the fastest growing of the P2P mobile options, with a reported 202% growth in 2015.

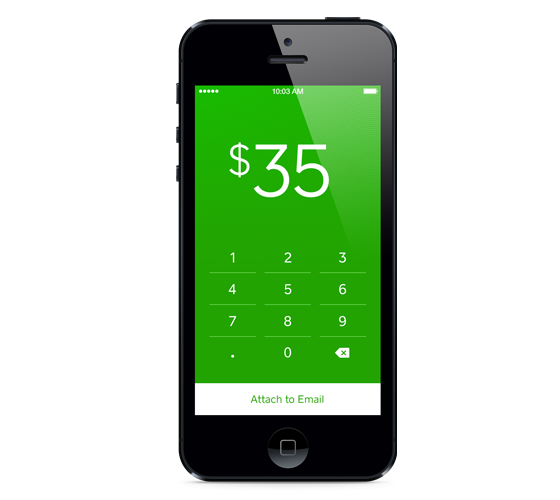

Square Cash, which went public in 2015, makes it very easy to send or receive money directly from or to a bank account linked to your debit card, and most of the payments deposit instantly — though some can take one to two business days, depending on the bank. This is a big differentiator between Square Cash and other apps, which keep money sent to you in your app’s account as a balance; from there, you have to take the extra step of transferring the money to your bank account. Square Cash is designed for use with debit cards, and it’s free of charge. It also has the advantage of allowing you to send and receive money with $Cashtags, a unique screen name that allows you to pay or receive payment anonymously — and it’s the easiest way for non-Square Cash users to pay you. They just need to click on a link to go to your cash.me profile.

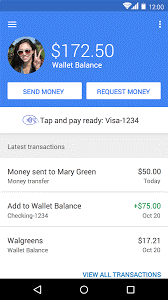

Then there’s the new Google Wallet, released in September 2015. Unlike the old Google Wallet app, the new one is exclusively for P2P payments. What happened here is that Google split up the mobile payment functionality and money management into two different apps: Android Pay (for in-store and eventually online transactions), and the new Google Wallet (for P2P money transfer and the use of a physical Wallet Card). Google Wallet makes it free to send money directly from your bank account, debit card, or Wallet balance, and allows you to send or receive money using an email address. Another advantage of the app is that spending limits are quite high: $10,000 per transaction, or $50,000 per five-day period.

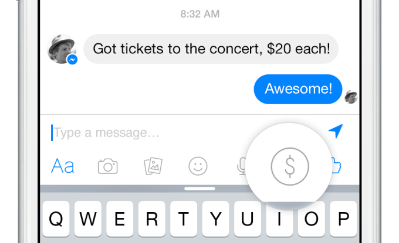

New Kid on the Block — Facebook Messenger

In March 2015, Facebook unveiled a new payments feature for Messenger. To use it, you connect a Visa or MasterCard debit card and tap a dollar button to send friends money, straight from your bank account. The free service is a big deal for Facebook — an opportunity for the social media giant to obtain and store the debit card information of everyone who uses the payments feature — and is another step in Facebook’s efforts to become an e-commerce engine, something along the lines of Amazon. Like Apple and Google, Facebooks wants both your time and your money.

As of March 2016, Facebook’s social network was being used by over 1.65 billion monthly active users (according to Facebook’s website), and Messenger already boasts around 900 million active users worldwide.

What About In-Store Payments?

Looking beyond peer-to-peer payment, there’s a whole new world of mobile wallet apps out there. These mobile solutions for in-store payments provide an entirely different set of capabilities, with Apple Pay, Android Pay, and Samsung Pay leading the way. The apps are far from seeing widespread adoption, however. Here are some of the key technological issues that are holding things up:

- NFC: The apps use information transfer technologies such as Near-Field Communications (NFC) to interact with appropriately equipped payment terminals — which poses a problem, since most business retailers don’t have the required NFC Reader.

- MFC: Of the three leading apps, Samsung Pay has an advantage with its Magnetic Secure Transmission (MST), which allows a contactless payment to be made with terminals that do not feature NFC readers. MST is a mobile wallet technology developed by startup LoopPay that can send payment information to conventional terminals in stores that have the old-fashioned magnetic strip, so that (unlike NFC) it’s accepted at most registers.

- Compatibility Problems: But Samsung Pay has other issues of compatibility — specifically, it’s only supported by the higher-end Samsung phones, and needs a US (not an international) model of those phones on a supported carrier.

As a result of these limitations, Google, Apple, PayPal, and a host of newer companies are exploring the development of digital wallets that utilize other technologies such as WiFi and Bluetooth.

Slimming Down Your Wallet

Widespread mobile wallet adoption may still be in the future, but don’t dismiss it. The technology has compelling advantages.

From the business side, digital wallets give retailers some new options. They allow businesses to offer customers a more convenient transaction processing method, providing those who employ the technology with a competitive edge in the market and incorporating a novel aspect into each purchase. Digital wallet apps also enable retailers to experiment and find new ways of integrating loyalty programs and coupons automatically into payment procedures.

Toward a Cashless Future

While the full impact of mobile wallet and P2P solutions remains to be seen, one trend seems clear: It paves the way for an increased number of credit card transactions. To understand the magnitude of the trend, keep in mind that in 2015, it is estimated that over two billion people used credit cards to make nearly 80 billion transactions, up over 100% from 2010.

Yet in 2016, nearly 85% of household expenditures, including taxes, rent, mortgage payments, car payments, and tuition payments, still demand payment by check or bank transfer.

As more and better mobile payment solutions enter the market, the mobile revolution is likely to expand the application of credit and debit cards, and bring additive transaction volume to the cards — allowing card networks to begin processing payments (for example) for things like taxes and tuition.

FinTech innovation is spurring a fundamental change in our payment habits, habits that are becoming increasingly mobile and increasingly card-based. Primarily, that’s because mobile is convenient — and in 2016, convenience is king.

—-

To find out more about alternative payment technologies and other investment opportunities on our platform, contact our Investor Relations team or visit our website.