Robots in the operating room: Making doctors — and healthcare — more efficient

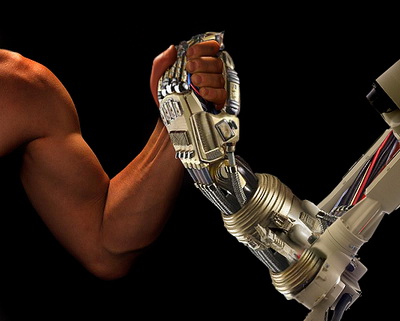

In Harl Vincent’s 1934 book “Rex”, a robot surgeon sought to remake mankind in the image of the robot. While he was (thankfully) unsuccessful in his pursuit, robots have certainly made their impact felt at a societal level. Robotic technologies are being introduced to a wide array of industries and have demonstrated their potential to save lives. The resident robots The first robotic system was introduced into the medical world in 1985. Dr. Yik San Kwoh of the Long Beach Memorial Medical Center used a robotic arm to direct a needle into his patients brain. Dr. Kwoh said about the surgery, ”The robotic arm is safer, faster and far less invasive than current surgical procedures.” Since then, robotics have played key active roles in the fields of surgery, rehabilitation and diagnostics. Surgery, in specific, is an area where robots are changing the way healthcare is delivered. Early technologies have mostly been aimed at assisting the surgeon, leading to a more efficient surgery. Robots in the Operating Room Perhaps the most well-known Israeli medical innovation using robotics is Mazor’s Renaissance. The...

Read More

![[Webinar] Making Sense of the JOBS Act: New Rules on General Solicitation](https://blog.ourcrowd.com/wp-content/uploads/2013/09/obama-jobs-act.png)