It’s not every day that investors get to buy a winning lottery ticket.

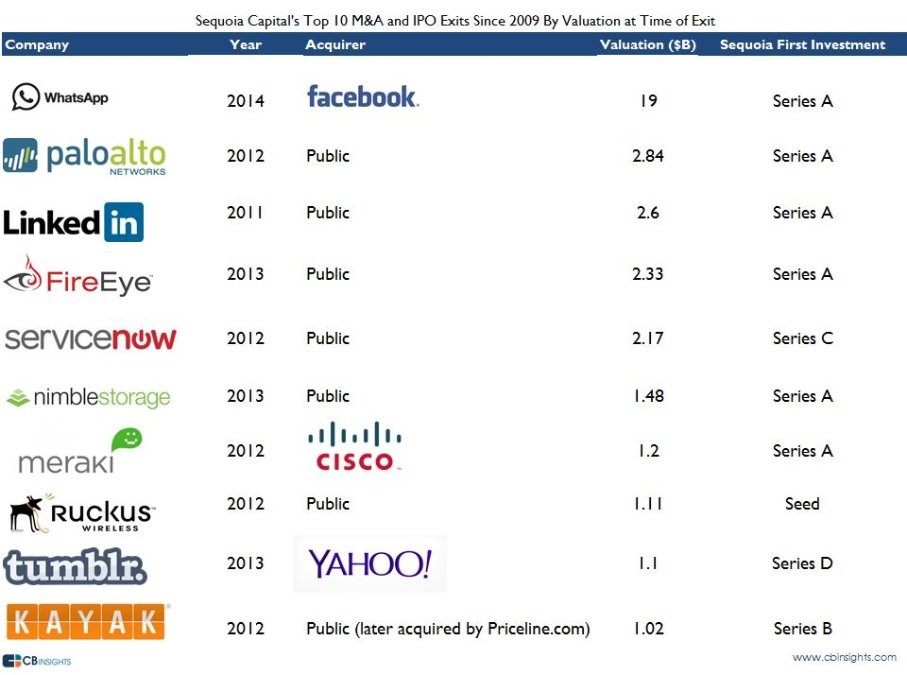

But, that’s exactly what happened when Sequoia Capital invested in WhatsApp in 2011 at a $8M valuation. WhatsApp turned out to be one of the largest VC-backed M&A in history (it was acquired by Facebook at a $19 billion valuation).

That’s a HUGE return for investors and it turns out that Sequoia happens to be pretty good at investing in startups in general. Check out the following chart that shows the VC firm’s top 10 M&A and IPO exits (just since 2009!) by valuation at time of exit.

So, it’s clear that Sequoia is pretty adept at investing. If you’re an individual investor reading this, you’re probably asking yourself: how do I invest in the next WhatsApp?

The answer lies with Sequoia. If you want to invest in the next WhatsApp, you’ve got to understand how Sequoia has created an assembly line of multi-billion dollar investments.

1) Understand the risk in each of your startup investments

In what appears to be a rare public domain investment memo, Miles Grimshaw found Sequoia’s investment memo considering making an investment in YouTube.

Assuming Sequoia maintained ~30% ownership in the company through the Series B, Roelof returned ~$480M on a cumulate investment of <$10M between writing this memo on September 2nd, 2005 and the sale to Google on October 9th, 2006 for $1.6B.

Great investment — but what got Sequoia interested in making the investment?

Roelof Botha, the author of the investment memo, writes a lot about the risks inherent in making an investment in a startup:

- Competition and Defensibility

- Revenue Model

- Scalability

- Balancing Growth

- Exit

Every investment has risks. The best investors in private companies use risk to their advantage to determine the investability of a company. To be able to pass muster, investors like Sequoia don’t ensure that there is no risk — that’s impossible (in fact, Grimshaw notes that over 50% of the memo focuses on the risks, not the opportunity). They do work very hard to understand what risks are involved, though, and what needs to happen for things to go right. Very right.

Ultimately, Sequoia’s venture capitalists have to make an investment recommendation. In the case of YouTube, the investment recommendation happened according to 3 lines of reasoning:

- Great team

- The growth of user-generated content with video as the next step

- Early indication of video ad potential based on diligence

2) Invest frequently in early and late stage companies

Thanks to the great guys at CBInsights, we can do a deep-dive into the famed investment house’s recent financings, exit activity, and investor analytics.

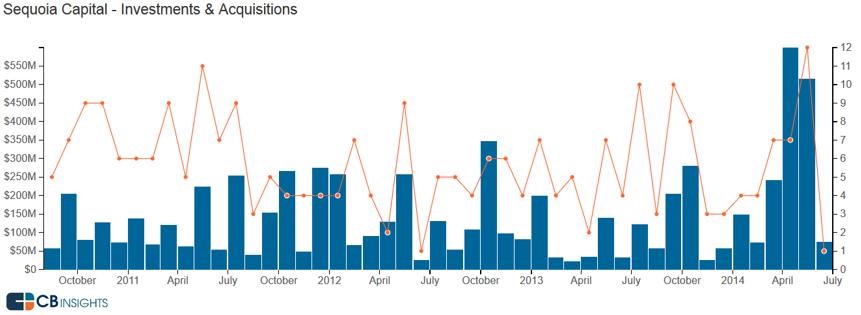

Sequoia is particularly good when it invests in later stage companies. As you can see below, not only is Sequoia participating in more deals during 2014 than it did all of last year, but the deal size is getting larger.

The firm isn’t investing as much in ideas — it’s putting (more and bigger) money into tech firms that have proven they can grow, as evidenced by the investment in AirBnB’s $500M recent round.

3) Diversify your investments across sectors and maturities

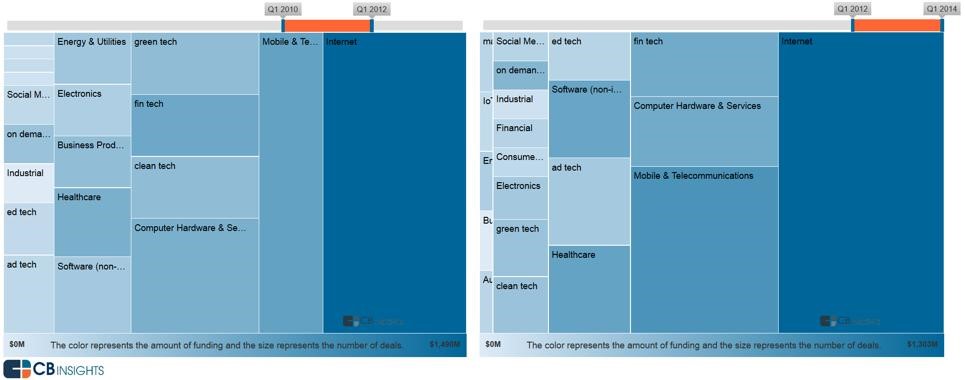

Of course, what Sequoia invests in changes over time based on technology diffusion, investment trends, and macroeconomics. The following image shows how Sequoia’s investing has changed over the past 4 years.

You’ll see the evolution of the firm’s portfolio with certain sectors like Internet and Healthcare getting more of an allocation. The important part of the discussion here is that the portfolio is well diversified, with numerous sectors receiving investments. That keeps multiple oars in the water so as those industries — and the companies within them — mature, Sequoia stands to profit.

Stages of investment: Sequoia’s barbell strategy

Sequoia does the most number of deals per year in Series A (26.7%), investing around $7M per deal at the median. From there, the numbers of deals go down as you move out on the maturity curve and sensibly, the deal size goes up (to about $40M in Series E).

$100M+ fundings to Coupang, SunRun, AirBnB, MongoDB, and Mu Sigma in Series C or later are consistent with these numbers.

While the ROI might not be so high on an Airbnb when compared to a WhatsApp, these pre-IPO investments are more likely to yield a profit in general.

4) Double down on your winners

Rob Go, a venture capitalist, wrote an interesting blog about why he believes Sequoia’s WhatsApp investment is even more impressive than it seems. It wasn’t the huge profit the firm made that got Go going…it was how Sequoia behaved throughout the lifecycle of the investment.

Though Sequoia invested early in the firm (at an $8M valuation), the firm continued to invest another $50M in the company. Other VCs would look for external validation for these continued investments. They search out other institutional investors to participate in further rounds. This may water down their ownership but for large investors, there’s a perceived safety in numbers.

But that’s not what Sequoia did with WhatsApp.

As an investor, you want to put as much money into your winners as possible. External impression or leverage be damned. When a company is ultimately successful, every VC thinks to themselves “man, we should have just invested more earlier”. But few firms actually do this. It’s hard, and takes a LOT of guts. Some folks on Twitter commented that Sequoia is a big fund, thus, this is easier for them. Sequoia is pretty big, but there are other VC funds that are of similar size, and I don’t see this behavior most of the time.

5) Search out global investments

Sequoia is very much a global firm. It was founded by immigrants and for the past 40 years, has invested in many of the U.S.’s top new talent.

But that’s changed over the years. Right now, the VC firm is focused on global opportunities.

As the chart from CBInsights shows, Israel (greater) and China (less) are major destinations for Sequoia investment capital. And if you look at some of the constituents in the company’s portfolio that are nearing large exit, you’ll see more and more of these international investments near the top.

If you can’t beat Sequoia, join ’em (sort of)

While many individuals and institutions would have a hard time convincing Sequoia to take their money (and you’ll need a big check), angel investing is opening up thanks to equity crowdfunding sites like OurCrowd and others.

Equity crowdfunding platforms open up the private company investment universe to individual investors who retain discretion to invest in what they like and to do some of the hands-on research themselves. OurCrowd, in particular, provides a due-diligence filter, so that investors who are members of the site can feel secure that the companies listed on the site for investment have been scrubbed and due-diligenced by a professional investment team.

Investing in startups is risky and one of the best things investors can do is research their companies well. Sequoia Capital has proven it can repeatedly identify, invest, and exit early stage investments based on a systematic investment methodology.

And now with crowdfunding, individual investors can attempt to do the same from the comfort of their own living rooms around the world.

[xyz-ihs snippet=”ZackMiller”]