When Sequoia Capital invested in Whatsapp, the venture capital firm didn’t know that within a short couple of years, the company would be sold for $19 billion (!). What they did know is that the firm employs a repeatable process to screen, diligence, and invest in high-powered startup companies in order to invest in what portend to be future billion dollar companies. There’s no doubt that this process has made the investment team — and its investors — very rich over the past couple decades.

And now, as equity crowdfunding platforms like OurCrowd are proliferating, individual investors are getting the opportunity to make their own investments in the next Google, Facebook, and Apple. There’s a lot to understand about the angel investment process: from how it works to understanding terms sheets to exiting your investments successfully. With this end in mind, I put together a list of some of the best resources to learn more about investing in startups.

Getting Started:

How to be an angel investor: Paul Graham’s 2009 essay is as relevant now as it was when he wrote it. He addresses everything a potential investor needs to know about investing in startups: from mechanics (the how to invest) to picking winners (what to invest in).

How to be an angel investor part 2: The VentureHacks guys, in fitting homage to Graham’s essay, deliver their own take on what it takes to be a successful angel investor, complete with slide deck.

What are the biggest misconceptions about angel investing?: This article does a good job of breaking down some of the commonly held misconceptions about angel investing (like how important demo days are).

Why startups fail: While many of the advice written about angel investing focuses on what makes a good investment, this collection of advice from some of the best angel investors around lists the reasons why companies fail.

Anatomy of a seed round: Using a startup’s experience in raising $1M from 14 top investors, this articles acts as a good cast study of what it takes to close a round in an early stage tech company.

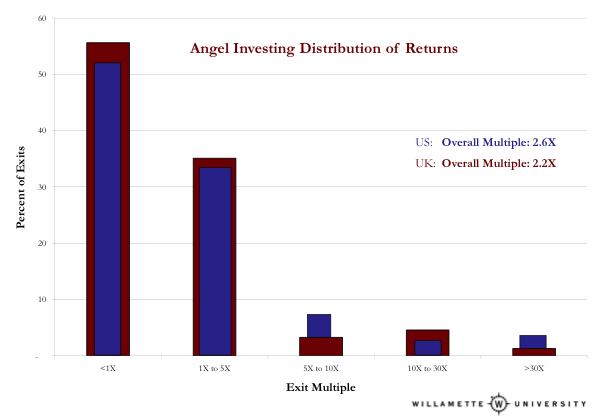

Returns of angel investing: In the largest study on angel investing, Robert Wiltbank found that angel investors averaged annual returns of 27% and identified 3 concrete things that can help boost any investor’s performance.

Why angel investors don’t make money: This article takes the opposite side of the Wiltbank discussion, arguing that the average angel investors doesn’t really make any money.

Top qualities to look for in angel investors: Keep in mind, entrepreneurs are also grading you on your ability to help them beyond just investing. It’s important to know what they’re looking for. This article helps.

How to avoid losing money as an angel investor: This post looks at best practices to help ensure that not only do you not lose money as an angel investor, but that you do very well with your investments in startups.

Deal flow

Why startup accelerators are a great guide for deal flow: Startup accelerators make it their business to identify high-potential startups. Investors could do worse than look to the graduates of accelerators — and the processes that accelerators use to identify the companies they work with — for good sources of investable companies.

The importance of proprietary dealflow: Mark Suster describes all the ways investors get introduced to new companies as potential investment candidates: from bankers (not a fan) to creating his own proprietary deal flow (his preferred method of choice).

The pros and cons of having employees cultivate deal flow: VCs can tap into strong populations of entrepreneurs (like MIT) for future deal flow. That’s an asset for students and employers who understand how this works.

Screening your investments

5 ways angel investors can invest in the next WhatsApp: Whatsapp was sold for $19B, making its core investors (Sequoia Capital) a LOT of money. Here’s how Sequoia invests and how angels can mimic their process.

The most important things a startup to warrant investment: Investing in startups successfully is every bit as much an art as it is a science. Here are various angel investors sounding off on what they look for in their investments.

How do you define ‘traction’ for a startup?: Many angel investors like to see a bit of early success for the companies they invest in. How you define ‘traction’ depends very much on your approach to investing.

Finding the next $1 billion exit: This post and slide deck looks at the process OurCrowd uses to screen for top investment candidates from over 100 companies per month.

What seed financing is for: Surprisingly, there isn’t a lot of consensus on the answer to this question. In fact, asking it over Twitter unleashed a tweetstorm. See what a few of the world’s best investors have to say.

Valuation

The OurCrowd guide to valuing a startup: The leading equity crowdfunding platform provides a broad overview of the various popular methods angel investors use to value startups. Here’s part 2 to the guide, as well.

The venture capital valuation method for startups: Bill Payne examines a popular method for establishing a valuation for pre-money startups by first focusing on how much money a startup needs to achieve positive cash flow.

Using the scorecard method to value startups: Bill Payne again on a methodology to value startups — this time, use a scorecard. (Link to pdf file)

How investors calculate valuation differently than entrepreneurs: This article, written by Mark Suster, goes through the math professional investors use to determine the valuation for the companies they invest in.

Investment terms and rights

Coming to terms with term sheets: What angel investors need to know about investment contracts, investment rights and terms.

Y Combinator’s investment docs: The famed investment incubator, Y Combinator, publishes its investment documents publicly.

Brad Feld’s term sheet series: Venture capitalist, Brad Feld defines and summarises all the terms and rights that go into an investment document.

Ideal first round funding terms: Chris Dixon shares his idea structuring of his early stage investment rounds.

FoundersFund’s Transparent Term Sheet: Here’s FoundersFund’s economic calculator to plug into a term sheet (along with a plain English guide to the terms)

Helping your investments

The Guide to Value Added Investors: This post lists the many ways angel investors can provide value to startup founders — early and later.

Some things truly committed angel investors do for startups: The ways you can help build value for the companies in your portfolio are many but they can fall into 3 categories: Wealth, Work, and Wisdom.

Exiting your investments

The psychology of an exit: Why do only 8% of companies who hire an M&A advisor sell? This post/video looks at the mental processes of all parties involved in a transaction.

I sold my startup for $25M — here’s how: This account goes through the entire process — from being contacted by an acquirer for the first time through due diligence and closing. Soon by you!

How to earn your wings and make money as an angel: Like a day trader, this angel investor recommends making quick profits and then taking some money off the table.

The Terminal Plan: How to exit your startup: This presentation describes how acquisitions happen and how startups can improve their chances in getting bought out.

Other angel investing resources

Which angel investing journals are the most useful?: While there aren’t any formal journals on angel investing (it’s too small of an industry), there are some valuable resources to study for budding — and experienced — investors, as this post points out.

Gil Penchina on This Week in Startups: Penchina built himself up from a relative outsider into one of the most formidable and respected angel investors in Silicon Valley. He talks with Jason Calacanis about how he accomplished that (and closed 70 investments in the interim).

Angel Investing: The Gust guide to making money and having fun investing in startups: David Rose, a long time and well-respected angel investor, shares everything an angel investor needs to know in his book.

List of the most interesting angel investors’ blogs: A lot of angel investors who have been around the block share their collective wisdom with their readers. Check ’em out.

CB Insights newsletter: This service, which provides data on private equity, has a newsletter that is a must read for insights into investing in startups and private companies.

Mattermark: Mattermark bills itself as a Bloomberg for Startups and its daily newsletter does a good job summarizing the writings of many of today’s top angel investors.

Wise: This tool sends you daily updates of all the companies you follow on AngelList.

Visible: Performance insights for angel investors’ portfolios

Next Step: