Take these 8 steps to become an all-star startup investor

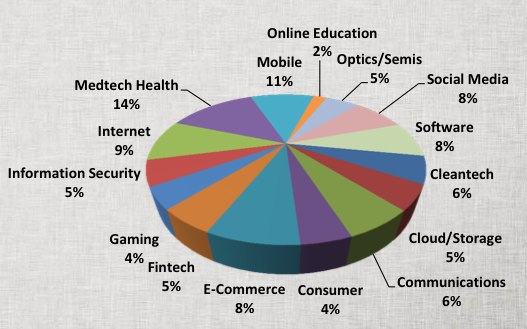

Show of hands: Who here doesn’t want to invest in the next Facebook or Google? Didn’t think so. The people who invest in startups have supplanted hedge fund managers as the investment rock stars of our age. What makes startup investing so thrilling is that unlike the passive investing common in the stock market (see our Ultimate Stock Market Investor’s Guide to Investing in Startups), angel investors have the opportunity to provide ongoing value with their experience… and Rolodexes. Whether you’re just kicking off your career as a venture capitalist or starting out in angel investing after making your money in other businesses, investing in startups can be a very lucrative activity. In fact, the data show that well-positioned angel portfolios can return 2.5X over a 4-year period. Returns like these easily trounce stock market returns (and historical returns of most other asset classes). However, investing in startups can be tricky. For example, it’s very likely that some of the startups you invest in will end up folding (less than 50% of startups never reach their 5th birthday). What are...

Read More