As investors in Israeli startups, we get asked this question a lot. In fact, we’ve dedicated significant slide-age to it in our presentations about why invest in Israel.

The environment for Israeli M&A

But here’s the hard facts according to the numbers:

First, in the aggregate

- Over the past decade, $15 billion has been invested in Israeli tech companies

- $37 billion take-out value in M&As and IPOs

- Average of 80 Israeli M&A deals per year (5 year average)

Israeli M&A environment for 2011

- average M&A deal: $60M (nearly double the $32.5M average in 2010)

- 15 deals over $100M, 5 deals over $300M, and 1 deal over $500M

- 5 IPOs (down from 11 in 2010) raised $126M

Multinationals come to Israeli to partner, acqui-hire, and acquire mostly early-stage technology companies. If you’re investing in Israeli ingenuity, then your investment model must reflect what’s going on on the ground.

We believe OurCrowd’s new hybrid model — screening/due diligence for good deals and giving total discretion to our investors to decide which deals they’d like to participate in — is a better mousetrap.

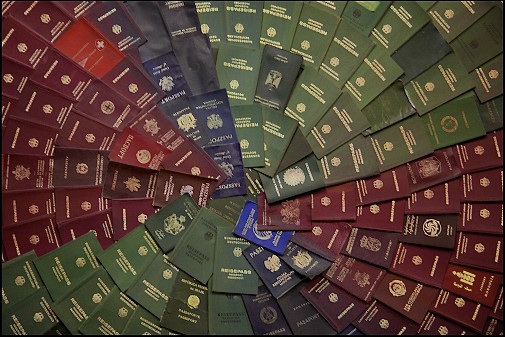

Photo courtesy of RonAlmog