Something old, something new, something borrowed… is a big opportunity in the online lending market.

In December 2014, investors with a keen eye on the world of fintech witnessed history in the making. First, Lending Club, an online peer-to-peer lending marketplace for unsecured consumer debt, began trading on the NYSE and within the month, had a valuation of over $9 billion. OnDeck, a web-based small business lender, followed suit with their IPO on December 17th, with a valuation at $1.5 billion.

That’s just the beginning of the story; there are a lot of reasons why the relatively young online lending industry heated up at the end of 2014 and will power investment opportunities through 2015. Before we go any further, let’s take a step back and understand what today’s online lending market fully entails.

The Good, the Big, and the Ugly: A Look at the Lending Industry

According to estimates, lending institutions generate $870+ billion each year in fees and interest from over $3.2 trillion in lending. Considered another way, the lending industry is larger than the automobile and airline industries combined.

But it hasn’t all been rosy from the consumer point of view: During the Global Financial Crisis of 2008-2009, when consumers and small businesses needed access to credit more than ever, many banks stopped offering loans and lines of credit. The combination of this liquidity crunch, new bank regulations, and increased dissatisfaction with the quality and cost of banking services, resulted in significant friction in the traditional lending industry and set the stage for the emergence of one of the hottest sectors of innovation in the world today: alternative finance and online lending.

The online lending market covers a lot of area; to divide by target, there are business and consumer loans. Drilling down further, loans are categorized as unsecured and secured. (For the sake of this article, we will focus on consumer lending.)

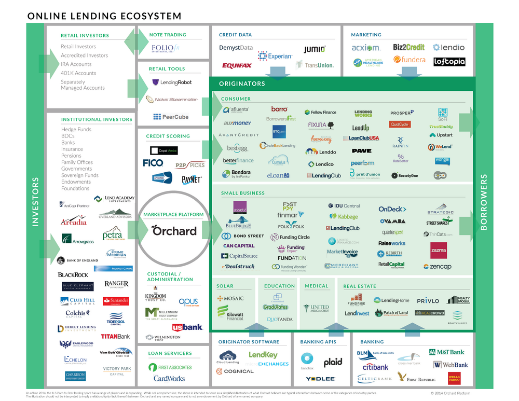

For a brief overview of the industry’s current players, check out Orchard’s recent infographic charting the greater online lending ecosystem:

Consumer Lending: Unsecured loans

An unsecured loan (also known as signature loan or personal loan) is a loan that “is issued and supported only by the borrower’s creditworthiness, rather than by a type of collateral.” (Investopedia)

By definition, unsecured loans are bigger risks to the lender. With no guarantee of collateral – like property, luxury asset, or other tangible good – lenders can’t be completely sure they will see returns. Interest rates are higher, and the interest collected on unsecured loans is not tax deductible.

Two well-known examples of unsecured lending platforms that take credit history into account are Lending Club, as mentioned above, and Prosper, (#15 on KPMG’s list) which is another leader in peer-to-peer lending. Pave and Upstart are also examples, but these companies do not facilitate loans based on credit history; instead, they forecast borrowers’ likeliness to be able to repay based on specific factors like education and experience.

Consumer Lending: Secured loans

The flip side of the unsecured loan is the secured loan: this is a transaction where the borrower pledges collateral to ensure payback of the loan. The collateral is usually a high-worth item like a car, piece of jewelry, or even property. If the borrower cannot pay back the debt, the lender can sell the item to regain the money lost.

To date, companies who deal in the secured loan model – or asset-backed lending – have been traditional, offline lenders. Corporate entities have the option of these kinds of services through national investment banks and regional banks.

‘Interest’ in Online Lending: The Opportunity for Investors

As investors in startups, we’re always seeking the next breakout opportunities – that are, of course, also market-proven. Lending Club’s IPO paved the way for the next class of successful online finance companies. We hope that Borro will be leading this class, and invite you to join us.

Check out the Borro investment opportunity on OurCrowd.

[xyz-ihs snippet=”LizCohen”]