Not for nothing is Israel the #2 startup ecosystem in the world — it has more high-tech startups and a larger venture capital industry per capita than any other country. Over the past few years, Israeli M&A has been (and still is!) on fire with a lot of excitement and hype around several multi-million dollar deals. The interest of international tech giants in Israeli startups is nothing new, and as we know, one of the major strategies for Israeli startups is to transform into appealing acquisitions for large entities knocking on its door.

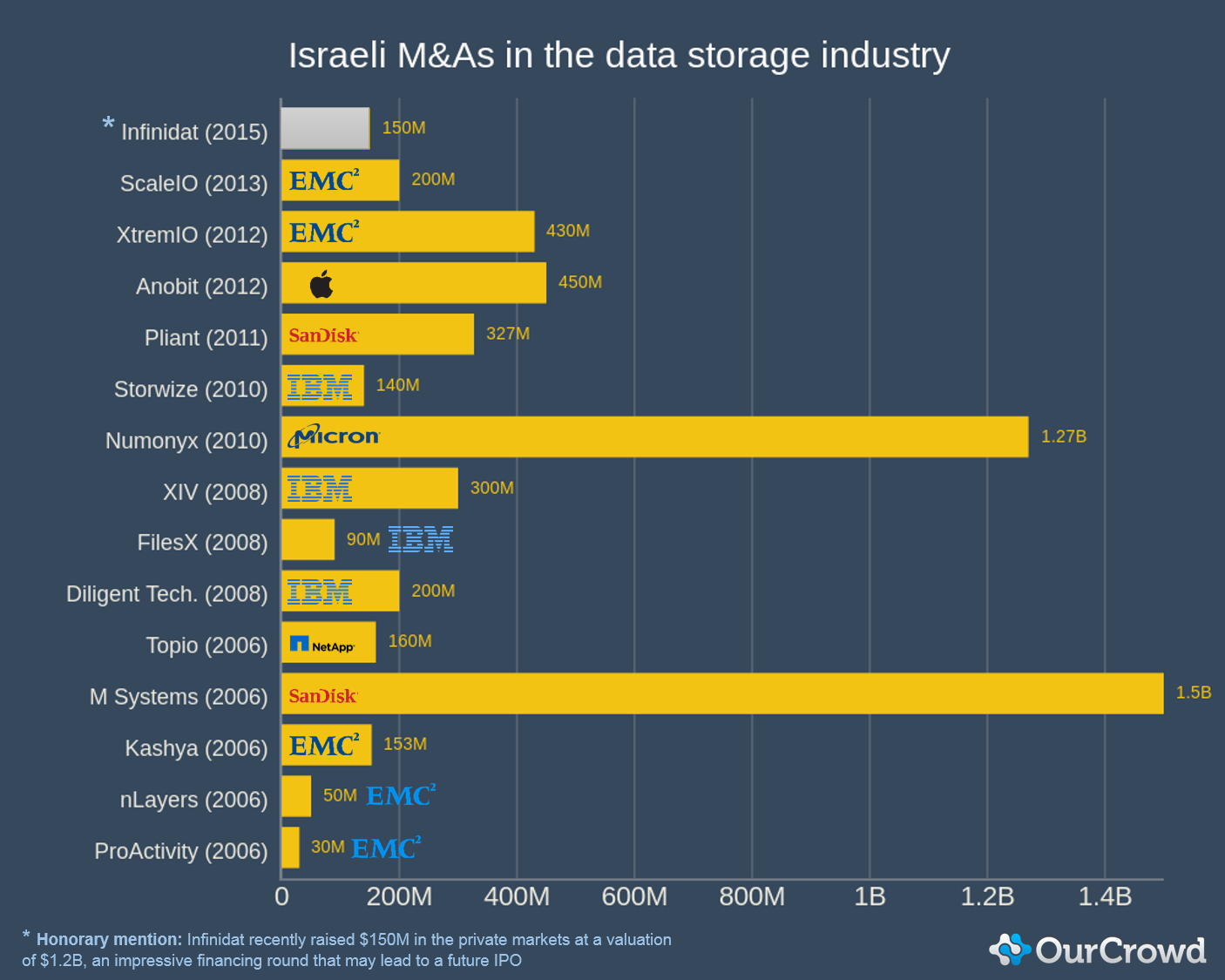

Some of the top high-tech M&As in Israeli history have come straight out of the data storage industry. These companies working on developing various storage solutions (from software to hardware, and in between) typically exit in the mid-hundreds of millions of dollars range.

Here’s an up-to-date look at the Israeli M&As in the data storage industry over the years:

A look to the (near) future of data storage

Dell’s recent $67B acquisition of publicly-traded storage giant EMC marked the largest single deal in the tech sector. As a prolific acquirer of storage tech, EMC’s management and ownership change may well impact the future of startup exits in this space and has set market analysts buzzing about what the future holds.